VF Corporation (NYSE:VFC), a leading apparel, footwear, and accessories company, is implementing cost reduction measures to enhance operational efficiency and remain afloat amid dwindling sales. The company will reduce its workforce by 500 employees on a global scale as part of this initiative.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This decision comes in response to mounting pressure from activist investors who advocated for cost reduction measures. Notably, Engaged Capital announced a stake in VF Corporation in October and is pushing for several changes, including a targeted $300 million in cost cuts. Concurrently, Legion Partners Asset Management, having quietly acquired a stake in the company, strongly emphasizes the necessity of cost-cutting measures and the divestiture of specific brands.

VFC’s Transformation Plan

VFC introduced Reinvent, a transformation initiative aimed at enhancing its performance in North America, driving the turnaround of the Vans brand, cutting expenses, and fortifying the balance sheet. Despite these efforts, the company withdrew its guidance for revenue and earnings for Fiscal 2024. Additionally, the company expects to generate free cash flows of $600 million, down from the previous estimate of approximately $900 million for Fiscal 2024. Management anticipates that the performance of Vans will not improve in the latter half of the current Fiscal year, and they are contending with a more challenging US wholesale market.

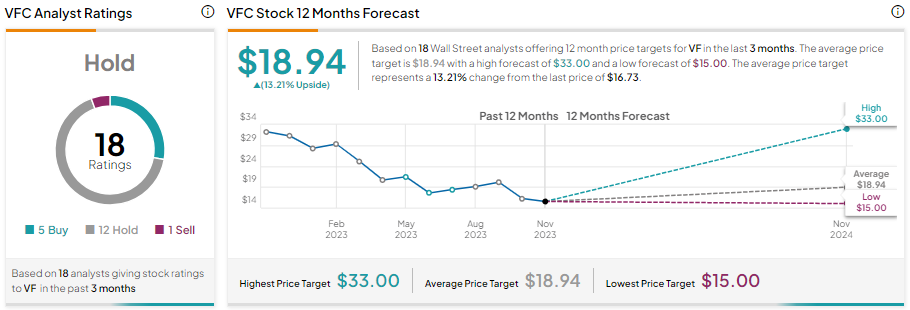

Given these challenges, there is a likelihood that VFC stock could continue to underperform the broader market. While VF Corporation stock is down about 37% year-to-date, analysts’ average price target of $18.94 implies 13.21% upside potential over the next 12 months.

With this background, let’s look at the Street’s forecast for VFC stock.

Is VFC a Buy, Sell, or Hold?

According to Wall Street analysts’ consensus rating, VFC stock is a Hold, reflecting five Buy, 12 Hold, and one Sell recommendations. Analysts remain sidelined on the stock as its top line continues to decline. VFC’s revenue declined 4% year-over-year in the first half of Fiscal 2024.