Vans are a great shoe; I’ve enjoyed that style of shoe for years myself. But a new report suggests that Vans might be an endangered species soon, and it’s already sent parent company VF Corp (NYSE:VFC) into volatile trading ahead of its earnings report Tuesday afternoon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The report in question, issued by a coterie of Wedbush analysts, says that any time you see a pair of Vans for sale, there’s roughly a coin flip’s chance—a little over 50%—that the shoes in question are being sold at a discount. The thing about it is, though, that Vans shoes are being discounted more often than other shoe brands that are covered by Wedbush analysts.

The news comes at a bad time for Vans, especially given that it’s set to report earnings after Tuesday’s closing bell. Analysts are looking for $0.14 per share in earnings and $2.72 billion in revenue. A heavily-discounted selection of shoes may not be the way to get there. Or, perhaps, it is; there’s an old marketing strategy known as “penetration,” in which a product is sold at a market-beating price to draw the budget-conscious shopper. And given the macroeconomic conditions on the ground these days, selling in a penetration strategy may be just the ticket.

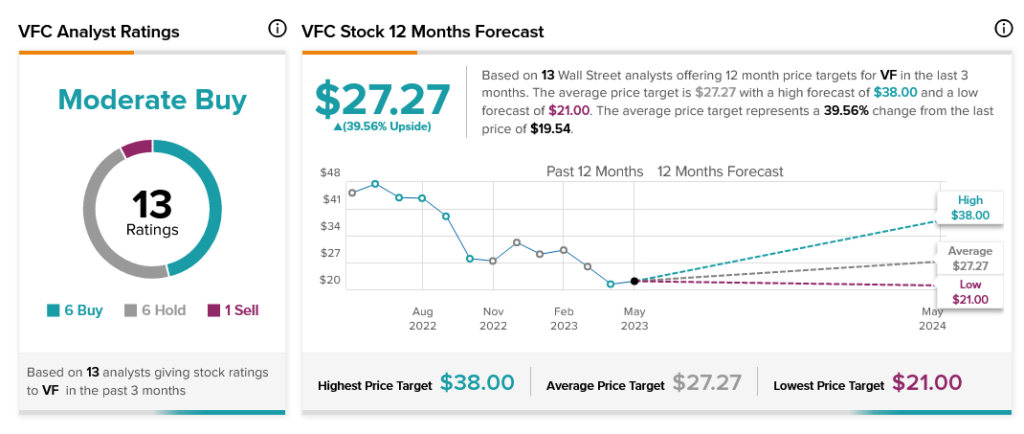

Analysts, however, are somewhat split on VF Corp’s overall fortunes. Six Buys, six Holds, and one Sell make VFC stock a Moderate Buy. However, those who do buy VF Corp stock get access to 39.56% upside potential thanks to its average price target of $27.27.