Artificial intelligence (AI) infrastructure stocks, such as Vertiv Holdings (VRT), are benefiting from the demand induced by the ongoing generative AI boom and the rapid expansion of data centers. Despite recent announcements by tech giants Microsoft (MSFT) and Amazon (AMZN) about their cooling tech, several analysts remain bullish on the prospects of Vertiv, which offers power, cooling, and IT infrastructure solutions. Let’s discuss what’s driving their optimism.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts Remain Upbeat on VRT Stock

Vertiv stock recently took a hit when Microsoft announced a new microfluidic cooling system for data center chips that removes heat up to three times more efficiently than cold plates, a cooling method that is currently used in data centers.

UBS analyst Amit Mehrotra highlighted that MSFT’s new cooling system could eliminate the need for cold plates by bringing liquid coolant directly into the chip. He noted that the announcement impacted Vertiv stock as the company is a market leader in liquid cooling, and investors are concerned about the “disintermediation risk” due to MSFT’s cooling tech.

Interestingly, the 4-star analyst explained that Vertiv is not in the cold plate business. Rather, it offers a fluid management system through a liquid cooling loop, which includes various components like heat rejection units, sensors, and controls. Mehrotra contends that, in his view, MSFT’s announcement will not impact the thermal management chain associated with this part of Vertiv’s business. “So, we don’t see valid fundamental negative read across implications for shares,” concluded Mehrotra, who has a Buy rating on VRT stock with a price target of $173.

Likewise, Roth MKM analyst Justin Clare reiterated a Buy rating on Vertiv stock with a price target of $162, saying that the pullback after Microsoft’s announcement represents a buying opportunity. Clare doesn’t expect Microsoft’s innovation to materially impact the infrastructure and solutions that Vertiv supplies to data centers. Moreover, he believes that recent announcements from Oracle (ORCL) and OpenAI (PC:OPAIQ) reinforce a strong demand backdrop for data center infrastructure, benefiting companies like Vertiv.

Previously, several analysts had shrugged off the impact on Vertiv from the potential in-house production of cooling components by Amazon’s (AMZN) AWS (Amazon Web Services) division.

Is VRT a Good Stock to Buy?

VRT stock has risen 28% over the past month and is up 41% year-to-date.

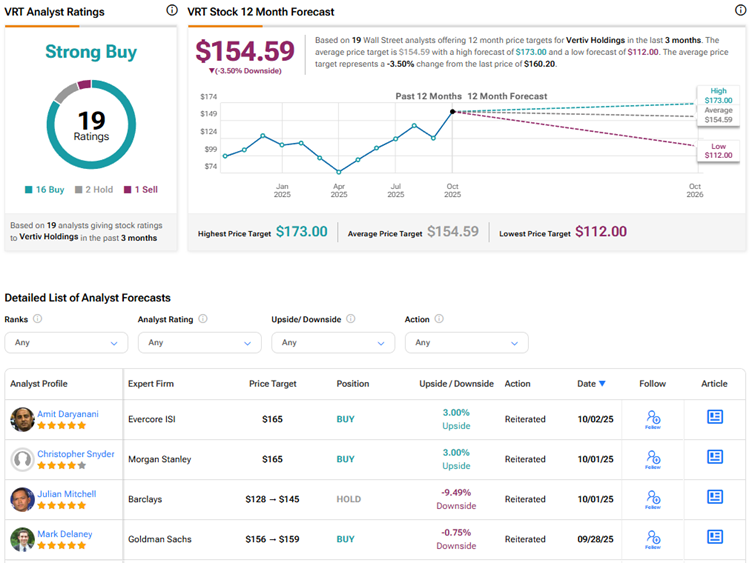

Wall Street has a Strong Buy consensus rating on Vertiv Holdings stock based on 16 Buys, two Holds, and one Sell recommendation. The average VRT stock price target of $154.59 indicates a possible downside of 3.5% from current levels.