Despite missing third-quarter expectations, Vertiv (NYSE:VRT) shares are up by double digits today after the digital infrastructure solutions provider raised its full-year outlook. The company expects net sales for the full Fiscal year 2023 to be in the range of $6,826 million to $6,851 million, with EPS for the year anticipated to fall between $1.68 and $1.73.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s third-quarter revenue rose by 17.6% year-over-year to $1.74 billion, although it fell short of expectations by $10 million. EPS of $0.24 also missed the cut by $0.08. Impressively, an 11% year-over-year jump in orders pushed the company’s order backlog to a record $5 billion, indicating robust market demand. Vertiv continued to benefit from favorable pricing, volume, and productivity gains.

As a pure-play data center infrastructure company, Vertiv stands to benefit from rising demand for data center infrastructure amid the current AI boom. For the upcoming quarter, Vertiv expects net sales to be in the range of $1,828 million to $1,853 million, with EPS for the period anticipated to range between $0.48 and $0.52.

What Is the Target Price for VRT Stock?

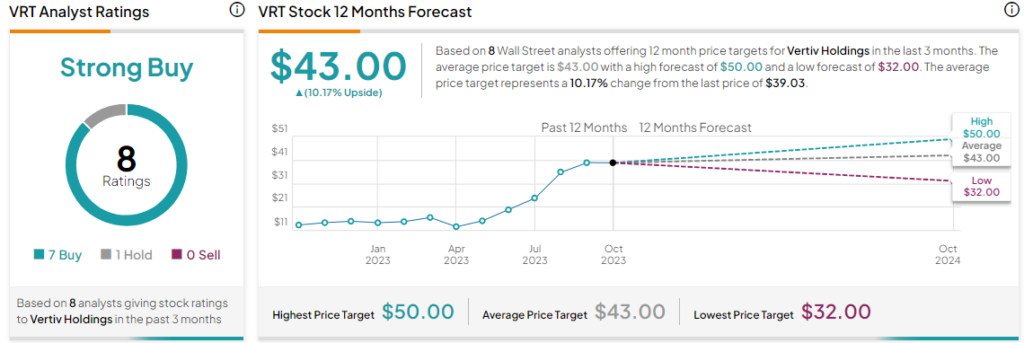

Overall, the Street has a Strong Buy consensus rating on Vertiv. The average VRT price target of $43 implies a modest 10.2% potential upside. That’s on top of a mega 183% rally in Vertiv shares over the past year.

Read full Disclosure