Vertex Pharmaceuticals (NASDAQ:VRTX) stock gained over 13% yesterday and hit a new 52-week high of $406 per share. The upside can be attributed to positive results for the Phase 2 trial of its pain medicine, VX-548. The company said that the drug showed a statistically significant reduction in pain caused by diabetes-related nerve damage.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The drug was tested for over 12 weeks in about 160 patients suffering from painful diabetic peripheral neuropathy. More than 30% of the patients reported a reduction in their pain levels by more than half, while 20% of the trial’s participants experienced a 70% reduction in pain levels.

It is worth mentioning that Vertex is conducting Phase 3 studies for VX-548 in the treatment of acute pain, with results anticipated in the first quarter of 2024. Also, VRTX plans to initiate a Phase 2 study in lumbosacral radiculopathy to expand the scope of this promising drug. Overall, the company expects VX-548 to become a viable alternative to opioid prescriptions for pain management.

Is VRTX a Buy, Sell, or Hold?

Following the announcement of the trial results, VRTX stock received four Buy ratings and one Hold. Goldman Sachs analyst Salveen Richter estimates that the promising chronic pain trial results unlock a potential total addressable market exceeding $9 billion for VX-548. Richter reiterated a Buy rating on the stock with a price target of $442 per share.

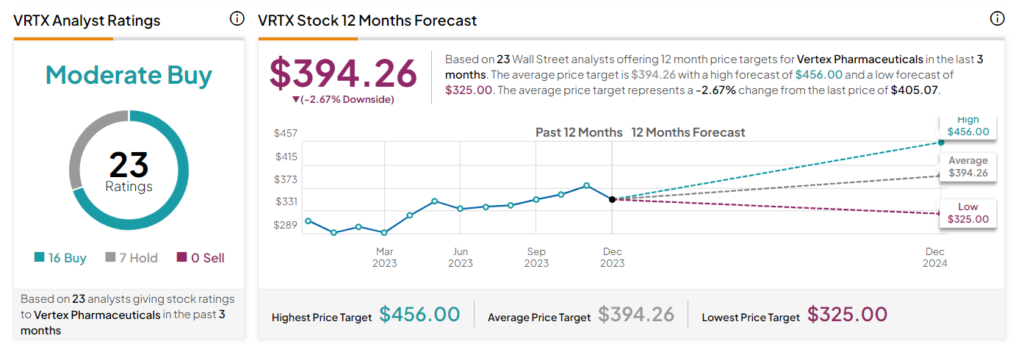

Overall, Wall Street analysts have a Moderate Buy consensus rating on Vertex based on 16 Buys and seven Holds. After having gained about 42% so far in 2023, the average VRTX price target of $394.26 per share implies 2.7% downside potential.