Verizon (NYSE:VZ) has teamed up with Netflix (NASDAQ:NFLX) and Max to offer a new streaming bundle service for its customers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Beginning December 7, Verizon’s myPlan customers stand to save nearly 40% with a $10 per month plan that will offer Netflix and Max services together. The ad-supported bundle is one of ten $10 monthly perks available to myPlan customers.

Further, customers can combine two content bundles with these perks, including the Disney bundle and the Netflix and Max bundle for $20 per month. Impressively, Verizon is leveraging its relationships in the content industry to provide more value for its customers.

This development is part of a broader trend of streaming competitors joining forces to retain subscribers. Apple (NASDAQ:AAPL) and Paramount Global (NASDAQ:PARA) have discussed a combined Paramount+ and Apple TV+ offering at a reduced cost compared to paying for both services separately. Disney (NYSE:DIS) has taken a similar approach with the packaging of Disney+, Hulu, and ESPN+ together. According to the Wall Street Journal, this move led to lower subscriber defections for the company.

What is the Forecast for Verizon Stock?

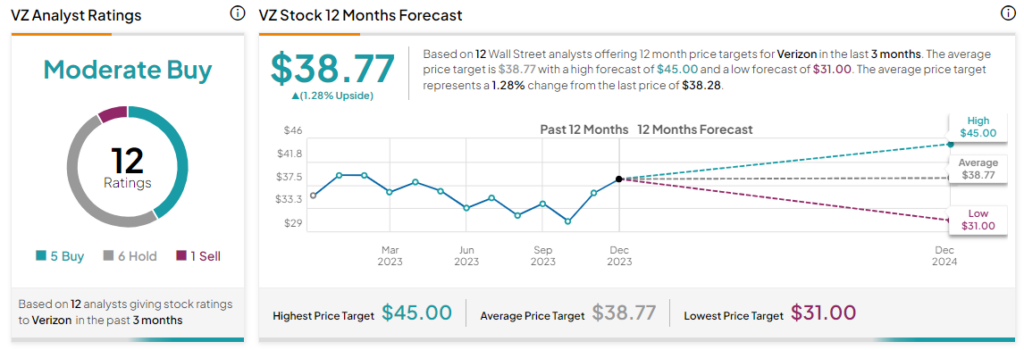

Overall, the Street has a Moderate Buy consensus rating on Verizon. Following a nearly 7% rise in the company’s share price over the past month, the average VZ price target of $38.77 implies that the stock may be approaching fair valuation levels.

Read full Disclosure