Telecom giant Verizon (NYSE:VZ) saw its shares surge by over 4% in the pre-market session today after its fourth-quarter revenue of $35.1 billion exceeded estimates by $500 million. Further, EPS of $1.08 was in line with expectations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For the full year, fixed wireless net additions jumped by 31%, and total wireless postpaid net additions increased by 26%. The company generated total operating revenue of $134 billion and $18.7 billion in free cash flow in 2023.

In the fourth quarter, total broadband net additions stood at 413,000, and the total broadband subscriber base hovered at 10.7 million. Verizon’s Q4 numbers included the impact of a $5.8 billion goodwill impairment charge and a mark-to-market adjustment of $992 million in its pension-associated liabilities. Total special items during the quarter stood at $7.8 billion.

For Fiscal Year 2024, Verizon expects total wireless service revenue growth to be in the range of 2% to 3.5%. EPS for the year is seen landing between $4.5 and $4.7.

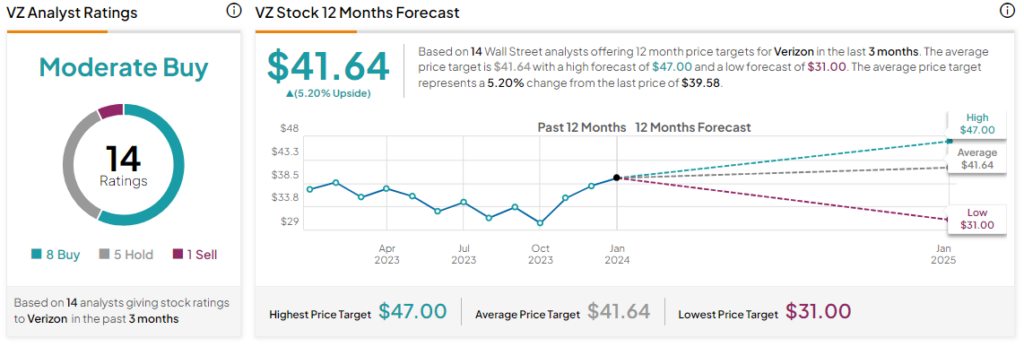

What is VZ’s Price Target?

Overall, the Street has a Moderate Buy consensus rating on Verizon. After a nearly 17% jump in the company’s share price over the past six months, the average VZ price target of $41.64 implies a further 5.2% potential upside in the stock.

Read full Disclosure