Shares of technology and communications services provider Verizon Communications (NYSE:VZ) are mildly lower today after the company delivered a mixed set of first-quarter numbers.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Revenue declined 1.9% year-over-year to $32.9 billion, missing expectations by $740 million. EPS at $1.20, on the other hand, managed to surpass estimates by $0.01. During the quarter, Verizon witnessed robust demand for fixed wireless and Fios offerings. Consequently, it had 437,000 net broadband additions during the quarter.

The company remains focused on network expansion and its 5G Ultra Wideband now caters to over 200 million people. Looking ahead, for the year 2023, Verizon expects wireless service revenue growth to hover between 2.5% and 4.5%. EPS is seen landing between $4.55 and $4.85. Additionally, the company expects to incur capital expenditures between $18.25 billion and $19.25 billion for the year.

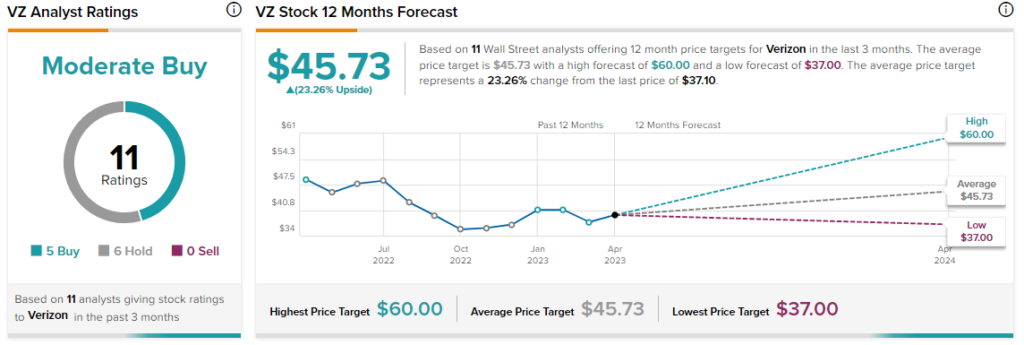

Overall, the Street has a $45.73 consensus price target on VZ, pointing to a 23.26% potential upside in the stock. That’s after a nearly 4.4% slump in VZ shares over the past five sessions.

Read full Disclosure