On Wednesday, Vera Therapeutics (NASDAQ: VERA) plunged by more than 60% in pre-market trading as the topline data for its Phase 2b clinical trial for atacicept left investors disappointed.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

VERA’s Phase 2b clinical trial evaluated atacicept used in the treatment of patients with immunoglobulin A nephropathy (IgAN). Nephropathy is the deterioration in the function of kidneys. The trial did meet its primary endpoint at 24 weeks and resulted in a 33% mean reduction in proteinuria from baseline.

However, there is a possibility that investors were expecting a better reduction in proteinuria.

The late-stage biotechnology company stated in its press release, “As a result of these positive data, Vera plans to advance atacicept into pivotal Phase 3 development in the first half of 2023, subject to and following discussions with the U.S. Food and Drug Administration.”

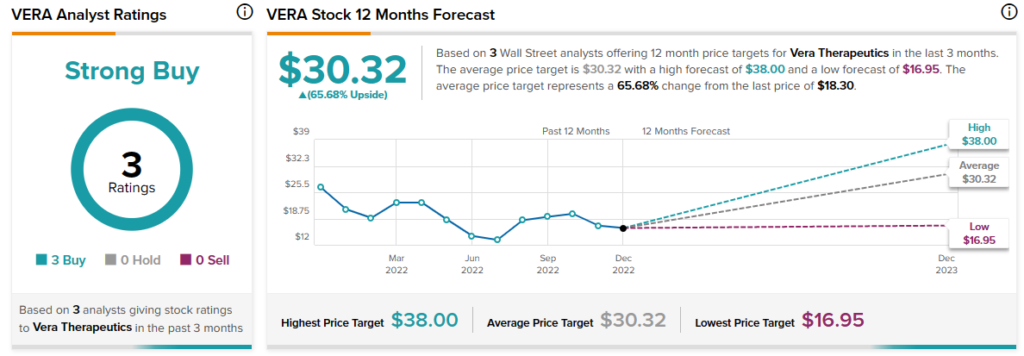

Analysts are unanimously bullish about VERA stock with a Strong Buy consensus rating based on three Buys.