Vectrus has signed an agreement to buy Zenetex, a leading provider of technical and strategic solutions to defense and national security clients globally. The transaction is valued at approximately $112 million and is net of an expected $11 million transaction-related tax benefit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vectrus (VEC) provides global service solutions primarily to U.S. government customers around the world. Headquartered in Colorado, Vectrus employs about 7,100 people across 26 countries and generated sales of $1.9 billion in 2019.

The deal makes Vectrus a global leader in the converged infrastructure market by expanding its capabilities and broadening its reach into the Intelligence Community. The acquisition will provide Vectrus with a contract backlog of over $700 million, building a foundation for continued growth and providing strong revenue visibility.

“This important acquisition significantly enhances our capabilities across a number of high priority clients and accelerates our strategy to deliver a more integrated and comprehensive suite of solutions to our clients globally,” said Chuck Prow, President and Chief Executive Officer of Vectrus. “Zenetex broadens our reach into the Intelligence Community and expands our engineering and digital technology offerings, which is critical as we expand our capabilities to help our clients’ transition to a more instrumented and converged approach to supply chain and facility management.” (See VEC stock analysis on TipRanks)

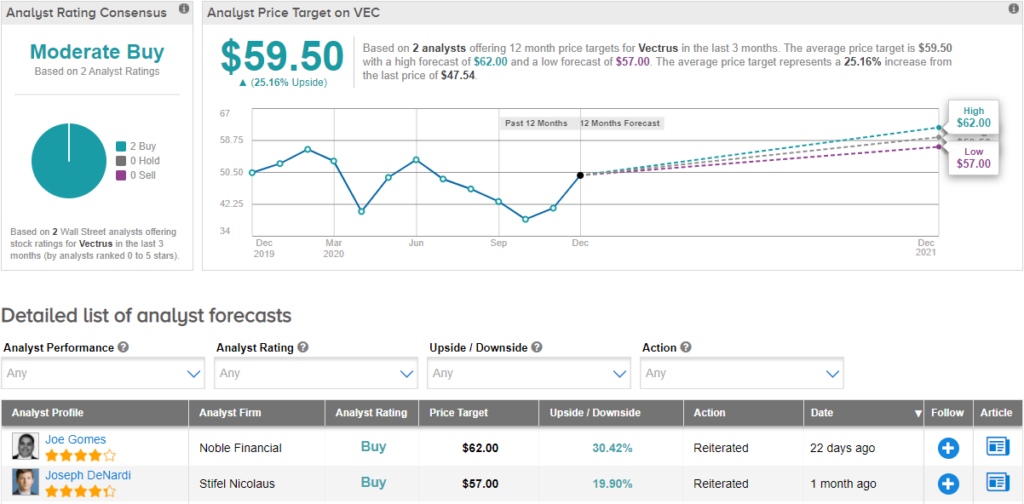

Noble Financial analyst Joe Gomes reiterated his Buy rating on the stock recently, setting his price target at $62. This implies upside potential of around 30%.

Commenting after the release of Vectrus’ third quarter results, Gomes stated that given the positive momentum around Vectrus’ other businesses, he foresees a much brighter future for the company once the coronavirus pandemic passes.

Overall, consensus among analysts is a Moderate Buy based on 2 Buy recommendations. The average price target of $59.50 suggests upside potential of around 25% over the next 12 months.

Related News:

Myovant Pops 20% On Pfizer Drug Collaboration; Goldman Sticks To Buy

Tesla To Debut In India Early Next Year – Report

Sprout Social Promotes Ryan Barretto To President; Shares Fall 4%