Coffee giant Starbucks (SBUX) seems to be having serious problems with one major portion of its Green Apron Service plan: the cup writing. Cup writing has been in the news quite a bit lately, and new reports about the rules governing the practice seem contradictory at best and laced with peril for baristas at worst. But investors were willing to extend the benefit of the doubt. Starbucks shares notched up fractionally in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Starbucks store operating manual seems reasonable enough at first blush. One section reads, “Starbucks prohibits the writing or printing of content on items that is inappropriate, offensive, or otherwise does not align with our Mission & Values.” That is reasonable, if a bit vague; calling on floor staff to make policy interpretations in the four minutes they have to make a drink and a connection seems like a long shot.

But the next part is where things get complex. It reads, “Partners should also not write or print content on items that advocates for a political, religious, or personal issue, even if requested by a customer.” That, on the surface, sure sounds like a contradiction to what Starbucks said just days ago about the use of the name Charlie Kirk on cups: “We are clarifying with our team now that names, on their own, can be used by customers on their cafe order, as they wish.”

More Menu Mods

Meanwhile, baristas at Starbucks will have a whole new problem to deal with as Starbucks plans to revamp its menu still further. We have already heard about some drinks making a comeback. Apple crisp drinks are back on the menu now despite them not having a presence as recently as last week. But that will not be the only place Starbucks faces a pullback.

In the next few months, reports note, Starbucks will be adding new menu items, with a particular focus on health. New drinks include high-protein options, as well as gluten-free options, to address biological sensitivities as well as open up a potential market in the “post-gym” crowd. The worldwide market for high-protein alternatives is already valued at somewhere around $52 billion, so for Starbucks to get a piece of that makes sense.

Is Starbucks Stock a Good Buy?

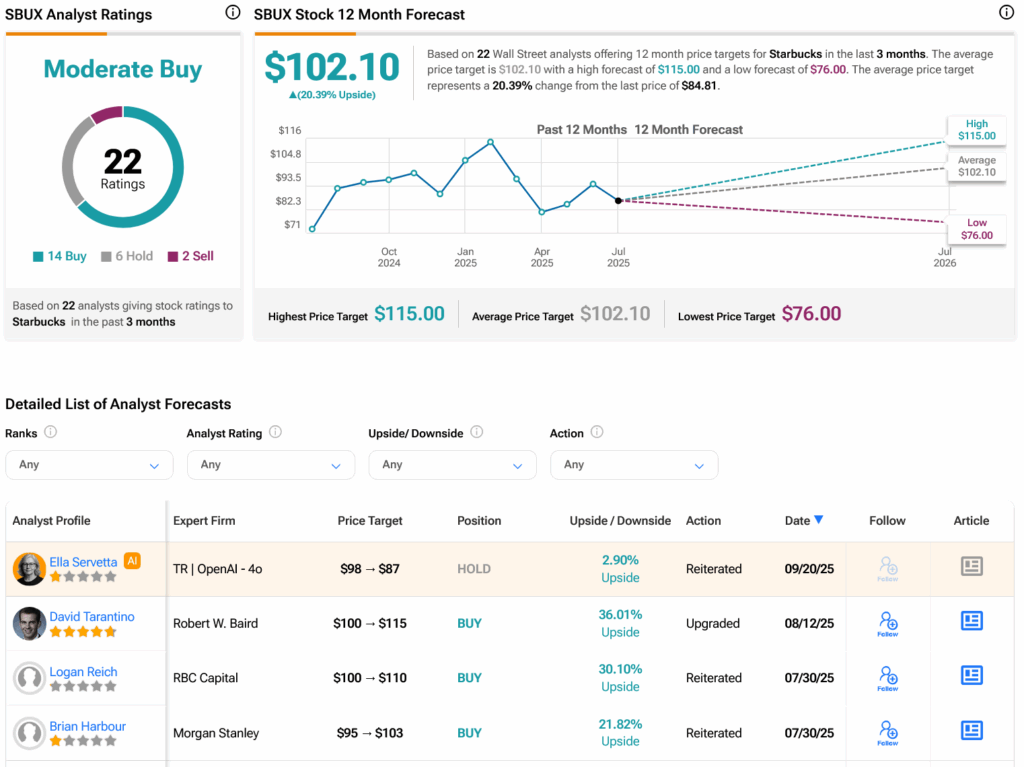

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SBUX stock based on 14 Buys, six Holds and two Sells assigned in the past three months, as indicated by the graphic below. After an 11.44% loss in its share price over the past year, the average SBUX price target of $102.10 per share implies 20.39% upside potential.