In this detailed analysis of the USD-JPY forex pair, we explore the implications of the latest technical indicators across daily, weekly, and monthly timeframes, offering insights into its potential direction.

Multiple Time Frame Analysis

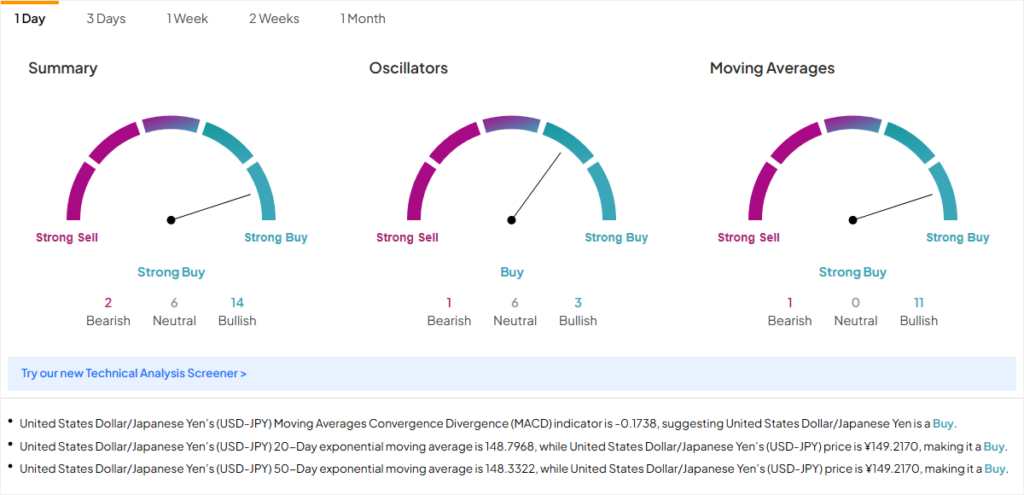

The USD-JPY pair shows a positive trend in the daily analysis. With the MACD indicator at -0.1738 and both the 20-day and 50-day exponential moving averages (EMAs) lying below the current price, the indicators suggest a Strong Buy signal for the day.

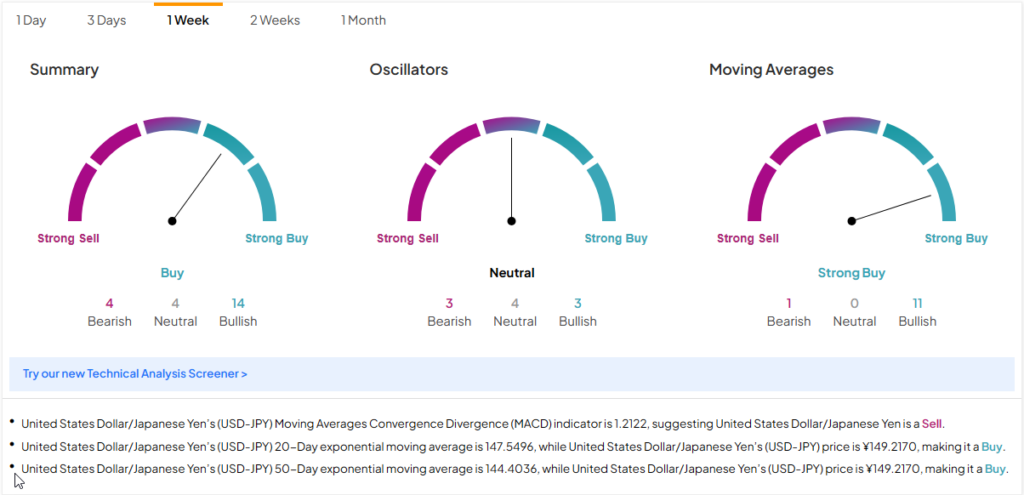

In the weekly analysis, the bullish momentum of USD-JPY is reinforced, although to a lesser extent. The MACD value of 1.2122 indicates a Sell, whereas the price exceeds both the 20-day and 50-day EMAs, further validating the Buying sentiment in the market.

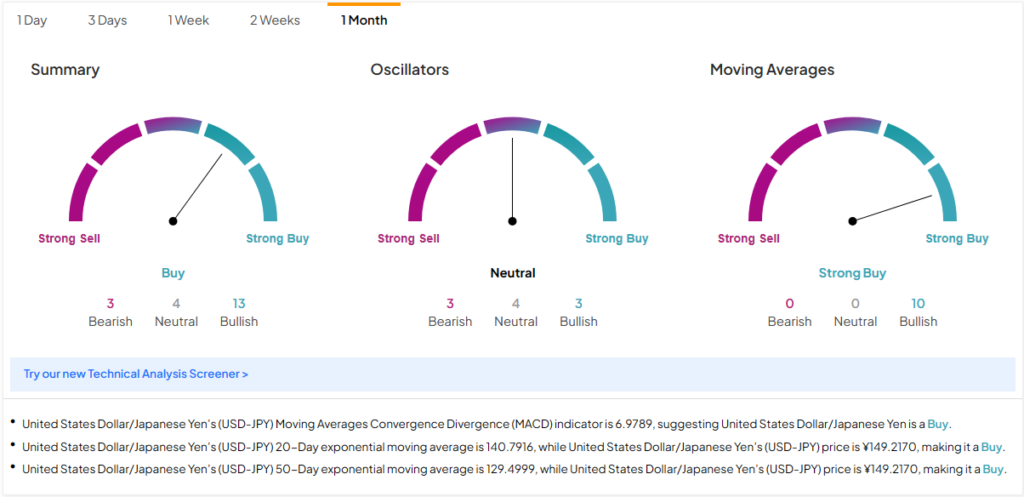

Furthermore, the monthly analysis exhibits a continuation of this bullish trend, with the MACD soaring at 6.9789. The significant gap between the current price and both the 20-day and 50-day EMAs underlines a robust bullish outlook for the pair.

Bullish Case

Considering the amount of Buy signals across all three analyzed timeframes, the bullish case for the USD-JPY pair is compelling. The positive divergence in the MACD values, coupled with a price above both the short and medium-term EMAs, suggests sustained upward momentum. However, if the Bank of Japan (BoJ) does end its policy of negative rates this week, then a flash crash is very likely.

Bearish Case

While the technical indicators predominantly support a bullish view, the bearish case might arise from potential market shifts or external economic factors that could reverse the current trend. These could include unexpected policy announcements from the Federal Reserve or Bank of Japan, geopolitical tensions, or significant changes in the global economic outlook that adversely affect the USD or bolster the JPY.

Given the prevailing technical indicators, the USD-JPY pair leans towards a bullish technical outlook. However, traders should remain vigilant for any market or economic developments that could influence this outlook.