Shares of nutritional and personal care products provider USANA Health Sciences (NYSE:USNA) are plummeting today after the company’s third-quarter showing landed short of estimates and revised guidance failed to buoy investor sentiment.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

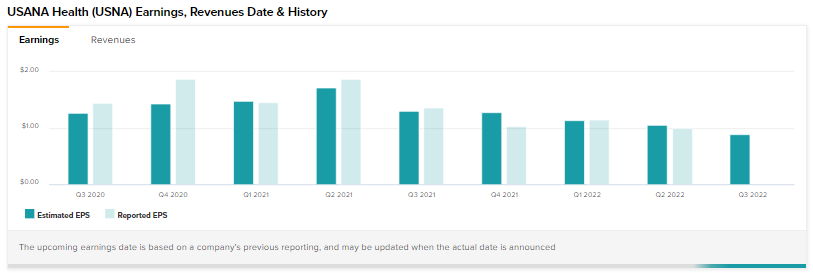

Revenue dropped 15% year-over-year to $233 million, lagging expectations by ~$11 million. EPS at $0.78 too, missed consensus by $0.11.

Further, USNA’s active customer count dropped 15% sequentially to 474,000. A challenging environment in the Asia Pacific and a rising U.S. Dollar impacted the company’s performance during the quarter.

For fiscal 2022, it now expects net sales to range between $955 million and $975 million. EPS is anticipated between $3.15 and $3.40 for the period.

Read full Disclosure