It’s an election year, you know, and that means a lot of things that aren’t normal suddenly become par for the course. Just ask U.S. Steel (NYSE:X), which finds itself at the center of a growing furor over whether or not its sale to Nippon Steel should be allowed. There are growing signs that it may end up disqualified after all, but that’s only slowing investors down a bit, as shares are down fractionally in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While previously, it was trade protectionists who were looking to the Biden Administration to put the kibosh on the U.S. Steel deal, now, it’s environmentalist groups who apparently have a problem. Said environmentalists note that both U.S. Steel and Nippon Steel aren’t exactly great shakes in the move away from fossil fuels, still relying on coal-powered blast furnaces, so letting the two merge operations might, apparently, somehow make things worse. The environmentalists want to see U.S. Steel sold to someone who will focus on electric blast furnaces, which are better for the environment, at last report.

The Political Consequences

Meanwhile, Joe Biden—whose approval rating is heading for the basement, depending on who you ask—is eager to pick up votes from the Rust Belt, where most of U.S. Steel’s operations are currently located. Given that Rust Belt locations often haven’t fared well economically—especially in economic conditions where environmentalists are listened to more than regular people—Biden could certainly stand some shoring up therein. But here, there’s not a whole lot of support; the United Steelworkers union touted “personal assurances” that the president “…has our backs,” but the promise seems to stop well short of shutting down the deal.

Is U.S. Steel Stock a Good Buy?

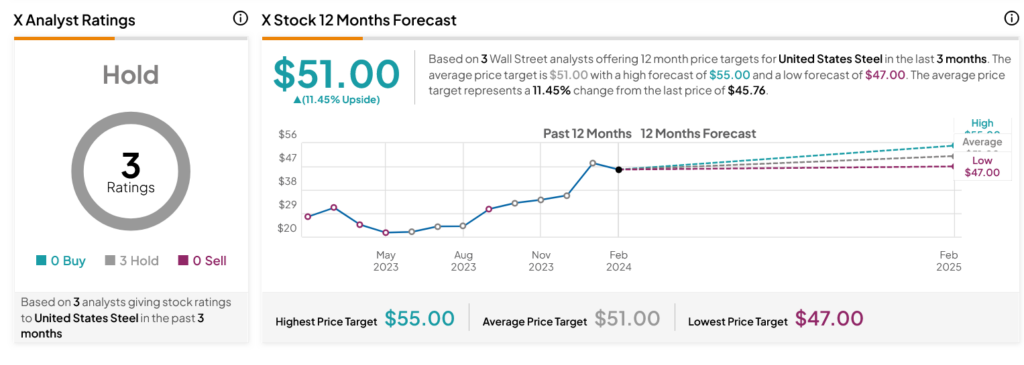

Turning to Wall Street, analysts have a Hold consensus rating on X stock based on three Holds assigned in the past three months, as indicated by the graphic below. After a 64.79% rally in its share price over the past year, the average X price target of $51 per share implies 11.45% upside potential.