Who would buy US Steel (NYSE:X)? Even just a few weeks ago, some might have thought “no one at all” would be the best answer. What with international steel sources presenting their produce, often at a lower cost, US Steel might have a tougher time competing. However, recent events have turned that notion on its ear, and US Steel was up over 5% in Wednesday afternoon’s trading thanks to growing popularity with potential buyers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earlier today, word emerged that ArcelorMittal (NYSE:MT) had an interest in making an offer to buy US Steel. While the offer hasn’t emerged yet, and is still in about the earliest possible stages, the second-largest steel company on Earth is still interested in making a play. Whether that interest goes to the cash on the table point or not, however, is anyone’s guess. And if it does, ArcelorMittal will find itself in a bidding war, as both Cleveland-Cliffs (NYSE:CLF) and Esmark have already put their own interest into the process.

And perhaps most interesting of all, United Steelworkers came out in favor of the Cleveland-Cliffs offer, noting that it “exclusively supports” their offer, calling it “the best way to preserve union jobs.” For those wondering why the union was being consulted to begin with, United Steelworkers actually has the right to counter such agreements. And even if such a deal is reached, there may be some complaint from the Federal Trade Commission. The Wall Street Journal noted that United States steel production is already largely concentrated with four major firms: US Steel, Nucor (NYSE:NUE), Steel Dynamics (NASDAQ:STLD) and Cleveland-Cliffs. Given the FTC’s recent passion for intervention, it may step in again on such a deal.

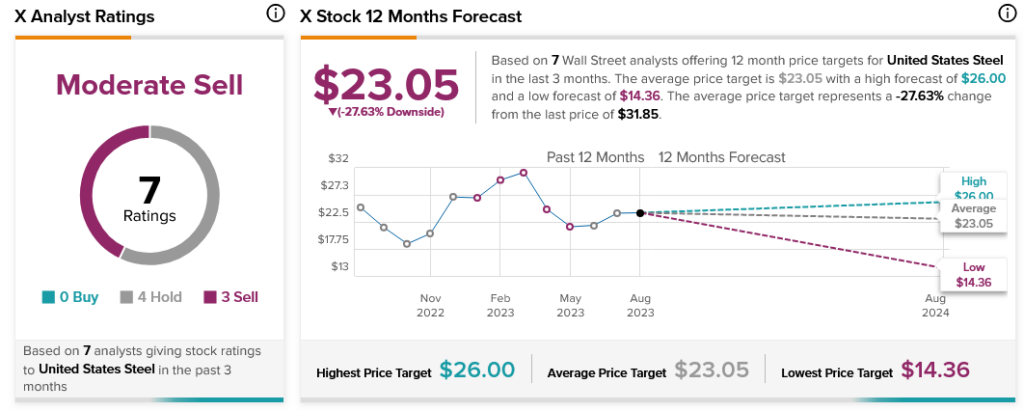

And, despite so many corporate figures interested in buying, analysts say investors should do anything but. With four Hold ratings and three Sell, US Steel stock is considered a Moderate Sell. Further, with an average price target of $23.05, US Steel stock comes with a 27.63% downside risk.