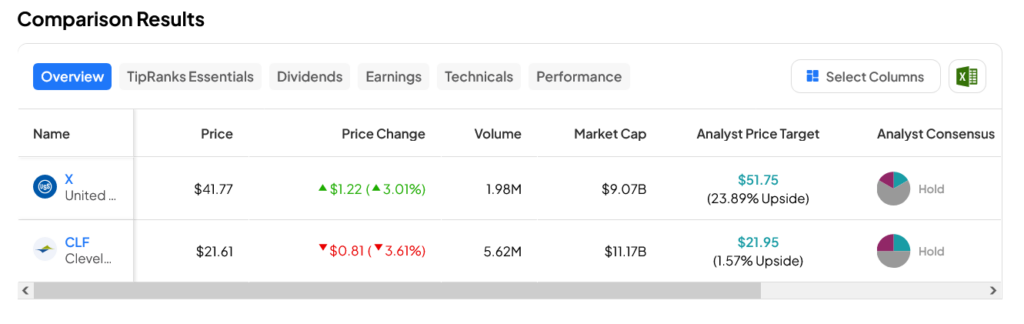

The saga of U.S. Steel (NYSE:X) isn’t done yet, and the deal between it and Nippon Steel is still somewhat up in the air. Meanwhile, Cleveland-Cliffs (NYSE:CLF) is lurking in the background, hoping to snap up its former rival should the deal ultimately fall through. But now, a new wrinkle has come into play: analyst perception. In fact, thanks to this latest pivot, U.S. Steel is up over 3% in Tuesday afternoon’s trading, while Cleveland-Cliffs is down over 3.5%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The word from Wolfe Research basically saw the two steelmakers move in different directions. For U.S. Steel—assuming the deal with Nippon Steel ultimately fails to come to pass—it’s actually in a pretty good position. Wolfe’s notes revealed that U.S. Steel is “…relatively cheap on a standalone basis” and thus hiked its rating from Peer Perform to Outperform, setting a $46 price target.

Meanwhile, at Cleveland-Cliffs, it was the opposite story. Cleveland-Cliffs went from Peer Perform to Underperform, as Cleveland-Cliffs’ free cash flow looked appealing to analysts but was likely to suffer given the company’s stated goals of pursuing more M&A activity. That move would cut into that cash flow with surprising speed. Wolfe also lowered Cleveland-Cliffs’ price target to $18.

A Deal in Jeopardy

Reports note that the deal between U.S. Steel and Nippon Steel is still floundering. With the union arrayed against it on one hand and the government looking to fight it on the other, there’s serious doubt that it will actually go through, at least before the election in November. Wolfe notes that there could be a deal made after the election for $55 per share for U.S. Steel. However, right now, it looks like anything could happen, and only time will tell how it all turns out.

Which Steel Stock Is a Good Buy Right Now?

Turning to Wall Street, analysts appear to expect more from U.S. Steel than Cleveland Cliffs. Indeed, they see 23.89% upside potential for the former versus 1.57% for the latter.