A $36 million check going out of any company should be a bit alarming. However, for bank stock US Bancorp (NYSE:USB), it didn’t shake up the investors much at all. In fact, investors sent shares up fractionally despite the big new check it was forced to write, a set of penalties to impacted customers.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Both the Consumer Financial Protection Bureau (CFPB) and the Office of the Comptroller of the Currency delivered judgments against US Bancorp. The CFPB had the lion’s share, requiring a $21 million payout, with $15 million going to the government as a penalty and $5.7 million being paid to individual customers. Meanwhile, the Comptroller’s office laid claim to another $15 million on top of that. The reason? The bank froze “tens of thousands” of individual customer bank accounts and required extensive paperwork—burdensome, as the CFPB called it—to recover access to their own money.

Security Robots, Branch Closures & More

While this latest case doesn’t do US Bancorp much in the way of favors, the rest of its landscape is somewhat off-kilter, too. For instance, it recently announced that it brought in a new robot to handle security at the US Bancorp Tower in Portland, Oregon. Known as “Rob,” the security robot in question allows for constant video surveillance with internally mounted cameras. Meanwhile, US Bancorp also revealed that, despite plans to close a growing array of branches, a recent acquisition will ultimately leave it with 70 additional branches compared to the prior year.

Is US Bancorp a Good Stock to Buy Now?

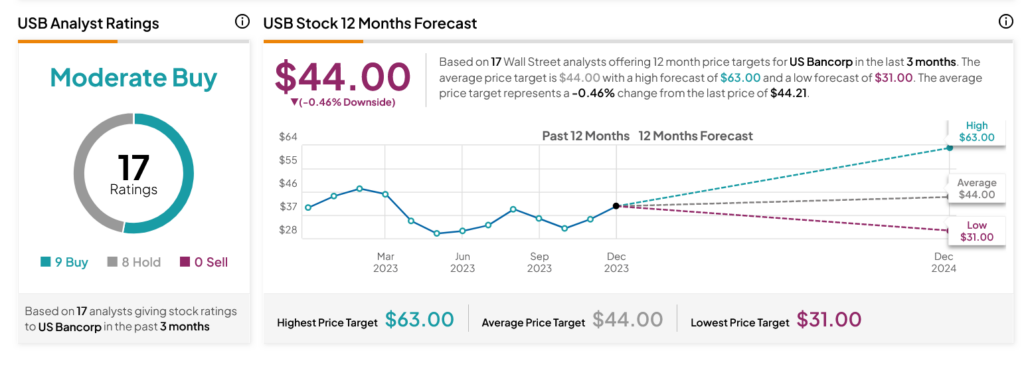

Turning to Wall Street, analysts have a Moderate Buy consensus rating on USB stock based on nine Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After an 11.23% rally in its share price over the past year, the average USB price target of $44 per share implies 0.46% downside risk.