Urban Outfitters’ (NASDAQ:URBN) shares traded more than 2% higher in yesterday’s extended trade after the company reported better-than-expected Q3 revenues. Robust demand for brands such as Anthropologie and Free People was apparent during the quarter, and supported revenue growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Quarterly revenues of $1.18 billion beat the Street’s expectations of $1.16 billion and increased 3.9% year-over-year. The company’s retail segment (about 91% of total sales) benefitted from mid-single-digit sales growth through digital channels, while the in-stores sales registered low-single-digit growth.

Yet, earnings came in at $0.40 per share for the lifestyle retailer, lagging analysts’ estimates by a penny.

Urban Outfitters continued to witness elevated inventory levels during the quarter. The company stated that Q3 inventory rose 19% due to higher inventory costs, improvements in the supply chain resulting in earlier receipt of shipments, and the considerably slow movement of products in certain categories. Nevertheless, the retailer expects inventory levels to decline in the fourth quarter.

Moreover, Urban Outfitters CEO Richard A. Hayne, said that he is optimistic about fourth-quarter revenue growth on the back of quarter-to-date sales and the upcoming Black Friday and Cyber Monday weekend.

Is Urban Outfitters a Buy, Hold, or Sell Stock?

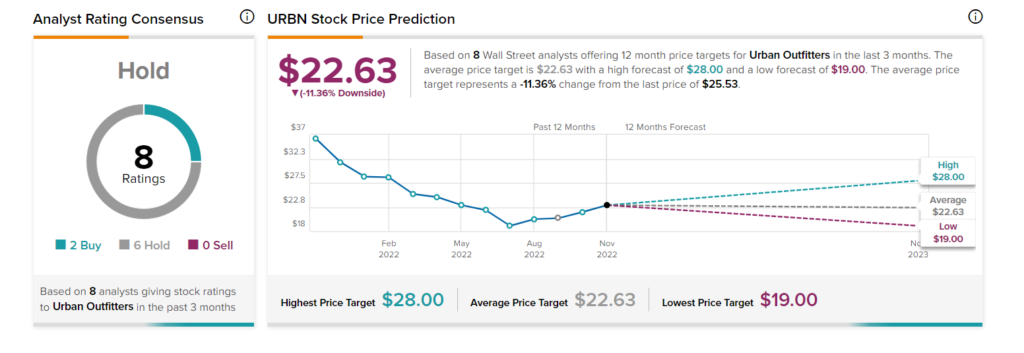

Urban Outfitters stock has a Hold consensus rating based on two Buy and six Hold recommendations. The average stock price target of $22.63 implies 11.36% downside potential.

In contrast to the analysts, our data shows that hedge funds bought 348.6K shares of URBN last quarter. Generally, hedge funds bulking up stocks is considered a positive sign.

Further, URBN scores an 8 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.