The concept of a clothing rental company isn’t exactly new. High school boys have been renting tuxedos for proms annually since time out of mind. But the idea of renting everyday clothes is a bit newer, and Urban Outfitters (NASDAQ:URBN) recently got into that line with its Nuuly concept. Despite reports that Nuuly is likely to be profitable in pretty short order, Urban Outfitters stock still slipped fractionally in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nuuly isn’t really new in and of itself; Urban Outfitters started up Nuuly back in 2019, and features not only its own brands, but also releases from Anthropologie and Free People, as well as fully 400 other brands. Since its inception, Nuuly gathered somewhere in the neighborhood of 198,000 subscribers. Given that Nuuly brass wanted 200,000 by the end of this year, there’s a distinct possibility they’ll make that goal, or at the very least, not fail by much. This is great news for Urban Outfitters, who will likely derive about $1 billion in benefit from Nuuly operations over the next three to five years, reports note.

And that’s not all; Urban Outfitters recently teamed up with True Religion to set up a new “capsule collection” for women shoppers. Right now, that capsule operation will only be available at 50 locations in the U.S., but those going internationally will have another 88 locations to choose from. Items available include a denim maxi-skirt, a “baggy cargo jean,” and a utility vest with multiple pockets. These are reflections of 90s and early 2000s era fashions, which should prove popular with an older female demographic.

What is the Target Price for URBN Stock?

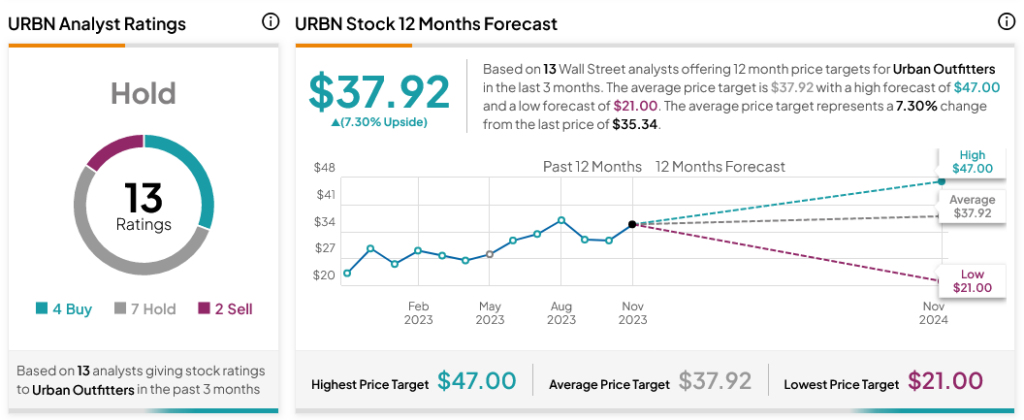

Turning to Wall Street, analysts have a Hold consensus rating on URBN stock based on four Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average URBN price target of $37.92 per share implies 7.3% upside potential.