Lifestyle retailer Urban Outfitters (NASDAQ:URBN) sank in pre-market trading even as the company reported third-quarter earnings of $0.88 per diluted share, more than double its diluted earnings of $0.40 per share in the same period last year. Analysts were expecting earnings of $0.82 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s Q3 net sales increased by 9% year-over-year to a record $1.28 billion, beating analysts’ estimates by $20 billion.

Richard A. Hayne, Urban Outfitters’ CEO commented, “We are proud to report record third quarter sales that helped drive a 120% increase in EPS. As we enter the holiday season the consumer continues to react positively to our assortments and marketing campaigns at four out of five of our brands which leaves us confident we can continue to drive revenue and earnings growth in the fourth quarter.”

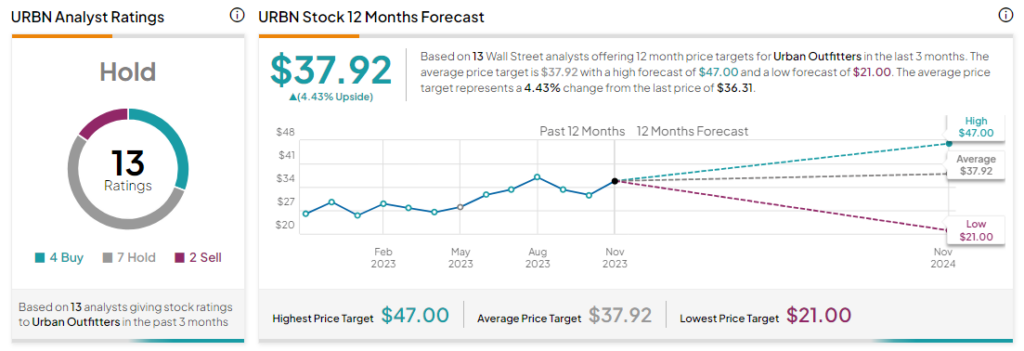

What is the Target Price for URBN Stock?

Analysts remain sidelined about URBN stock with a Hold consensus rating based on four Buys, seven Holds, and two Sells. While URBN stock has rallied by more than 48% year-to-date, the average URBN price target of $37.92 implies an upside potential of 4.4% at current levels.