Shares of logistics solutions provider UPS (NYSE:UPS) were down in morning trading today after the company delivered lower-than-anticipated first-quarter numbers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Revenue declined 6.1% year-over-year to $22.9 billion, missing the cut by $80 million. EPS at $2.20 came in line with expectations. The figure was significantly lower than the $3.05 per share profit a year ago. The company witnessed lower volume in the U.S. owing to tepid U.S. retail sales. Additionally, demand in Asia also remained weak.

Looking ahead, for the year 2023, the company expects sales and margins to remain at the lower end of its earlier guidance owing to challenging macroeconomic conditions globally. For the year, revenue is now anticipated at $97 billion alongside an operating margin of 12.8%.

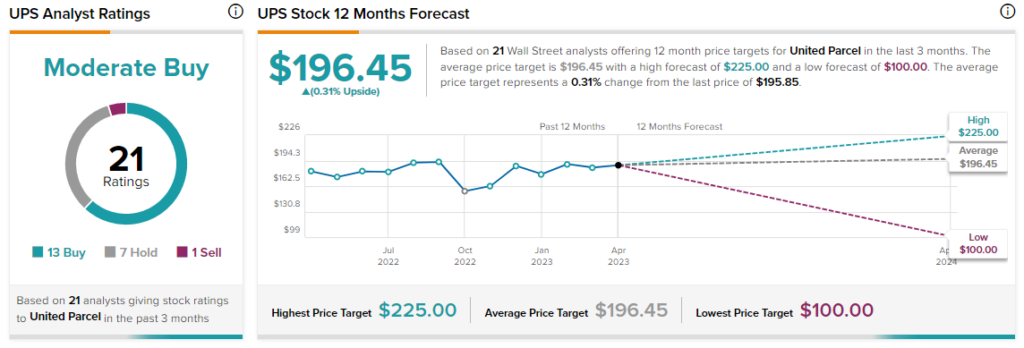

Overall, the Street has a $196.45 consensus price target on UPS, implying the stock may be fairly priced at current levels. That’s after a nearly 12% runup in UPS shares so far in 2023.

Read full Disclosure