Pharmacies like CVS Health (NYSE:CVS) often prove to be winners in the stock market due to the essential nature of their business. Yet, today wasn’t a complete win for CVS. Indeed, it got hit with a new warning letter from the FDA, but it also landed an upgrade from an analyst who liked what CVS was putting out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bad news was that CVS Health got itself a warning letter from the Food and Drug Administration (FDA). Interestingly, Walgreens Boots Alliance (NASDAQ:WBA) got a similar warning letter over a similar matter. Specifically, it’s related to a line of pink eye relief drops that are an unapproved new drug product. The product’s label notes that it relieves several eye-related symptoms, including the “sensation of grittiness,” “excessive watery discharge,” and “redness and burning.” CVS called it a “homeopathic remedy,” but the FDA still noted it had requirements about that sort of thing too.

However, CVS got some praise from Wolfe Research. Word from analyst Austin Gerlach cited the stock’s growth in preferred provider organization (PPO) operations and a possible “inflection point” coming within the next year. Gerlach expects more “realistic” long-term goals to come out of CVS, particularly at its upcoming Investor Day event this December. He looks for a low-to-mid single-digit decline in retail operations for 2025 and beyond. However, he was sufficiently enamored to upgrade CVS from a “peer-perform” to an “outperform” and gave it a price target of $80 per share as well.

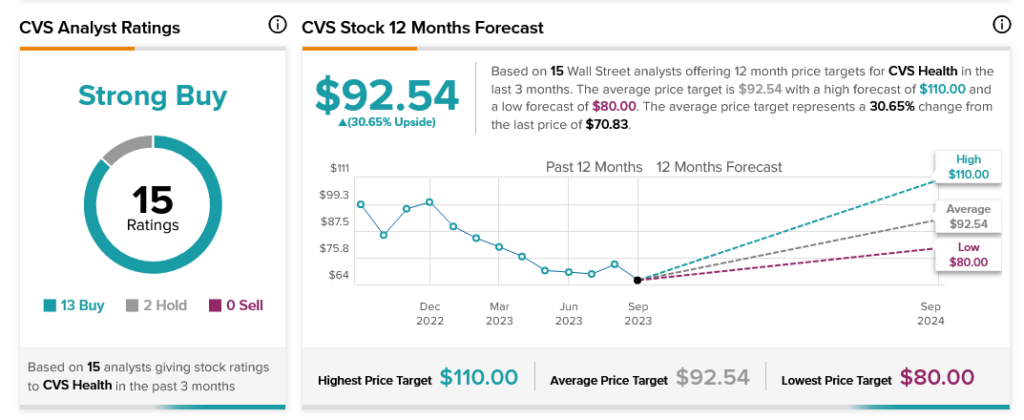

All told analysts are very much on CVS’ side here. With 13 Buy ratings and two Holds, CVS Health stock is considered a Strong Buy by analyst consensus. Further, CVS Health stock offers investors 30.65% upside potential thanks to its average price target of $92.54.