It was good news today for clothing chain Urban Outfitters (NASDAQ:URBN) and its investors. Shares were up fractionally after an analyst reconsidered and decided things weren’t quite so grim for the firm as they were previously. Urban Outfitters’ positive word came from UBS, who upgraded shares from Sell to Neutral.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Essentially, the long-term risks in the system have declined, giving Urban Outfitters some new room to run in the field. Among the risks that lessened were macroeconomic headwinds—which UBS believes are in decline, at least as far as they’re concerned for Urban Outfitters—as well as improvements for the Nuuly clothing rental service.

Solid Fundamentals Seen to Help

It would be easy to dismiss Urban Outfitters as another mall-facing retailer that’s probably on its last legs. But that’s oversimplifying, as far as some reports go. Urban Outfitters has some impressive numbers to its credit, including a 9% growth rate, a 6.48% net margin, and a debt-to-equity ratio of 0.53. All of those numbers add up to a surprisingly robust picture, which should put it in a good position going forward, especially if that part about macro headwinds comes to pass.

Is URBN Stock a Good Buy Right Now?

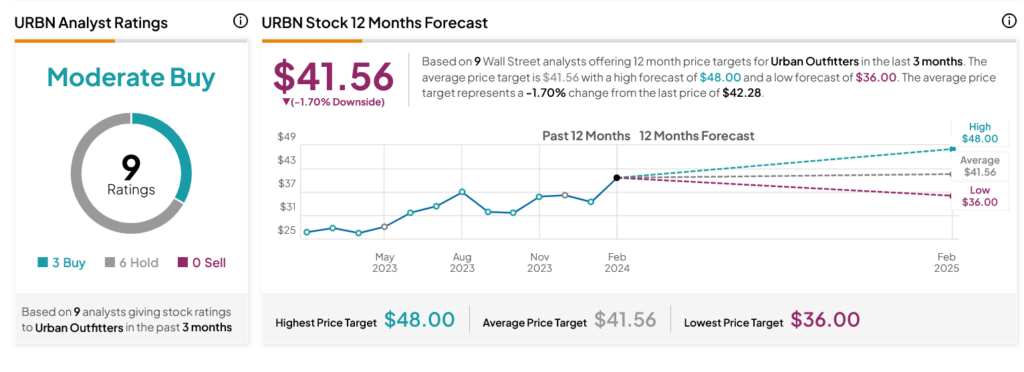

Turning to Wall Street, analysts have a Moderate Buy consensus rating on URBN stock based on three Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 56% rally in its share price over the past year, the average URBN price target of $41.56 per share implies 1.7% downside risk.