These are the upcoming stock splits for the week of September 29 to October 3, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action that reshuffles a company’s share count without changing its overall market value. Existing investors receive additional shares, the total number of shares rises, and the price per share falls – a move that often makes the stock more approachable and attractive to retail buyers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sometimes, though, companies take the opposite path. A reverse stock split reduces the share count while lifting the price per share. The valuation stays the same, but the tactic is usually aimed at meeting exchange listing rules, such as Nasdaq’s minimum bid price, and fending off delisting.

Whether the goal is to broaden investor appeal or simply stay compliant, these moves often send signals that the market pays close attention to.

Let’s take a look at the upcoming stock splits for the week.

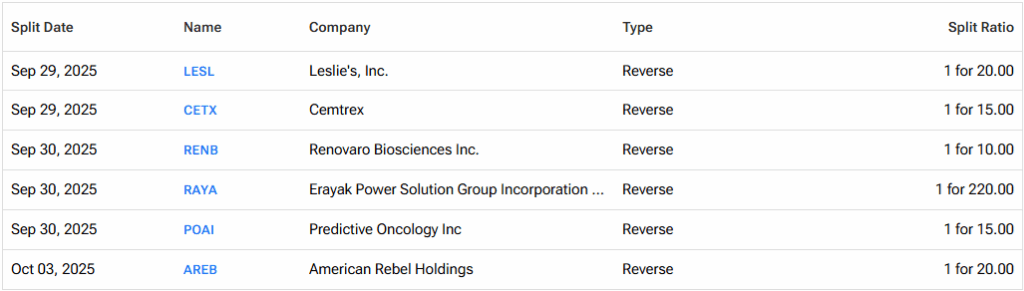

Leslie’s (LESL) – Leslie’s is a leading U.S. specialty retailer dedicated to swimming pool supplies, equipment, and services, operating more than 1,000 stores nationwide alongside a growing e-commerce platform. On September 18, the company announced a 1-for-20 reverse stock split as part of its effort to regain compliance with Nasdaq’s minimum bid price requirement and strengthen investor perception. The split took effect on September 26, with shares trading on a split-adjusted basis beginning September 29.

Cemtrex (CETX) – Cemtrex operates across security technology, industrial automation, and IoT solutions, with offerings that include smart surveillance systems and environmental monitoring. On September 24, the company unveiled a 1-for-15 reverse stock split to restore compliance with Nasdaq’s minimum bid price rule and consolidate its share base. The split becomes effective on September 29.

Lunai Bioworks (RENB) – Lunai Bioworks, formerly known as RenovoRx, applies AI and precision medicine to advance drug discovery and personalized therapeutics. On September 24, the company announced a 10-for-1 reverse stock split, designed to lift its share price and maintain its Nasdaq listing. The split will take effect on September 30, 2025.

Erayak Power Solution Group (RAYA) – Erayak, incorporated in the Cayman Islands with operations in China, develops and markets power generation systems, inverters, and other clean energy solutions for industrial and residential use. On September 8, the company approved a massive 220-for-1 reverse stock split of its ordinary shares, a move aimed at consolidating shares and keeping its Nasdaq listing intact. The split is scheduled to take effect at the start of trading on September 30.

Predictive Oncology (POAI) – Predictive Oncology is a biotech firm leveraging artificial intelligence and vast tumor biology data to improve drug discovery and predict patient response to therapies. On September 25, the company announced a 1-for-15 reverse stock split as part of its strategy to comply with Nasdaq’s minimum price rule and streamline its capital structure. The split becomes effective on September 30.

American Rebel Holdings (AREB) – American Rebel markets branded safes, personal security products, and outdoor lifestyle gear, with a mission rooted in self-defense and protection. On September 23, the company announced a 1-for-20 reverse stock split (after earlier authorizations allowing up to 1-for-25), intended to enhance marketability and ensure continued compliance with Nasdaq’s minimum bid price rule.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.