These are the upcoming stock splits for the week of November 10 to November 14, based on TipRanks’ Stock Splits Calendar. A stock split might sound technical, but it’s really just a way for a company to make its shares more accessible. By issuing extra shares to existing investors, the total share count rises while the company’s overall market value stays exactly the same. The share price drops accordingly, often making the stock look more affordable and inviting to a broader pool of investors.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sometimes, though, companies take the opposite path. A reverse stock split combines shares instead of dividing them, cutting the total number while boosting the price per share. The company’s value doesn’t change, but the move is typically meant to meet exchange listing requirements such as Nasdaq’s minimum price rule and avoid delisting.

Stock splits and reverse splits can reveal a lot about a company’s situation or intent, and investors who spot those signals early often gain an edge.

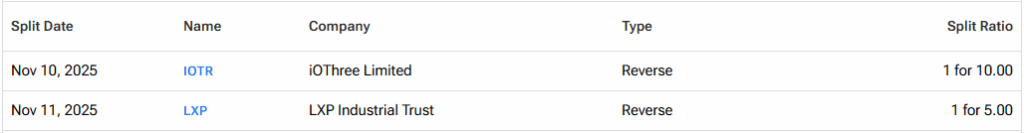

Let’s take a look at the upcoming stock splits for the week.

iOThree Limited (IOTR) – Singapore-based iOThree provides maritime digital technologies, offering satellite connectivity, AI-enabled analytics, and digitalisation solutions for the global shipping industry. The company operates through two main segments: Satellite Connectivity Solutions, which provides satellite network services and onboard equipment leasing, and Digitalisation Solutions, which offers an integrated suite of products such as the JARVISS platform, smart-ship monitoring systems, AI-powered surveillance, cybersecurity tools, and weather-based route optimisation software. On November 6, the company announced a 1-for-10 reverse stock split as part of its efforts to comply with Nasdaq’s minimum bid price requirement. The split is set to take effect on November 10.

LXP Industrial Trust (LXP) – A U.S.-based real estate investment trust (REIT) specializing in Class A industrial warehouse and distribution properties across the Sunbelt and Lower Midwest regions. The company focuses on acquiring, developing, and managing single-tenant logistics facilities leased to creditworthy tenants, positioning itself to benefit from the growing demand for e-commerce and supply chain infrastructure. On October 30, the company announced a 1-for-5 reverse stock split aimed at boosting its share price and ensuring continued compliance with Nasdaq’s listing requirements. The split is set to take effect on November 10.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.