The initial public offerings (IPO) market is heating up again, and two fresh names are joining the queue. These include Beta Technologies, the Amazon (AMZN)-backed electric aircraft maker, and life insurance technology company Ethos Technologies, backed by Google (GOOGL) Ventures. Both companies have officially filed for U.S. IPOs, reflecting their aim to tap public markets amid increased investor appetite.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BETA Prepares for IPO amid Aircraft Expansion

Beta is best known for its electric vertical takeoff and landing (eVTOL) aircraft, designed for cargo and regional passenger transport. The company has already secured partnerships with UPS (UPS) and the U.S. Air Force. Also, its flagship aircraft, ALIA, is undergoing FAA certification.

The IPO filing comes as Beta ramps up production and expands its charging infrastructure across North America. Also, it is developing a larger aircraft, which could carry about 19 passengers.

The company has filed for an IPO on the New York Stock Exchange, aiming to trade under the ticker symbol “BETA.” Morgan Stanley (MS) and Goldman Sachs (GS) are serving as the lead underwriters.

Ethos Files for IPO under ticker “LIFE”

Ethos, founded in 2016, uses AI and data analytics to simplify life insurance applications, offering coverage in minutes without medical exams. The company has raised over $400 million from investors, including SoftBank (SFTBF), Google Ventures, and Accel.

It filed for an IPO on September 26 to list its Class A common stock on the Nasdaq Global Select Market under the ticker “LIFE.” Goldman Sachs and J.P. Morgan (JPM) are leading the offering.

The IPO filing suggests Ethos looks to scale its platform and compete with traditional insurers.

Rebound in IPO Market

After two years of sluggish activity, the IPO market is showing signs of recovery. As of late September 2025, more than 250 companies have gone public on the NYSE and Nasdaq, surpassing the full-year totals of 2023 and 2024.

Specifically, the third quarter saw the most initial public offerings and $100 million-plus deals since 2021, with major listings from fintech and technology firms.

Some high-profile listings, such as Klarna (KLAR), Figma (FIG), CoreWeave (CRWV), and Firefly Aerospace (FLY), saw strong first-day gains and helped renew investor interest.

Overall, 2025 is on track to be the busiest IPO year since 2021, with more deals coming in Q4 from AI, cybersecurity, and digital infrastructure companies.

What Other IPOs Are on the Way?

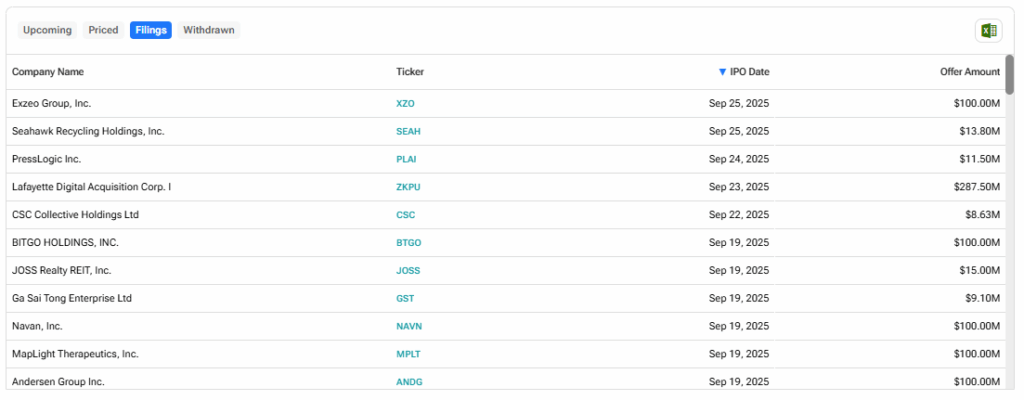

Let’s take a look at a list of IPO filings on the TipRanks calendar.