Financial technology company Global Payments Inc. (NYSE: GPN) caught investors’ attention on Monday after it posted upbeat earnings for the second quarter of 2022 and announced an agreement to buy EVO Payments, Inc. (NASDAQ: EVOP) in a $4-billion transaction.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earnings beat in the quarter stood at 0.9%, while sales surprise was (0.5%). Shares of the $34.4-billion payment solutions provider grew 4.6% to close at $127.98 on Monday.

Highlights of GPN’s Q2 Performance

In the quarter, Global Payment’s adjusted earnings were $2.36 per share, above the consensus estimate of $2.34 per share. Also, the bottom line grew 15.7% from the year-ago tally.

Adjusted revenues were $2.06 billion in the quarter, below the consensus estimate of $2.07 billion. On a year-over-year basis, the top line expanded 6.1%, driven by healthy segmental performances.

Revenues of the Merchant Solutions segment rose 11.3% from the year-ago quarter to $1.43 billion, and the Issuer Solutions segment’s revenues grew 2.8% to $0.46 billion. However, revenues of the Business and Consumer Solutions segment declined 17.5% year-over-year to $0.19 billion.

The adjusted operating income was $0.9 billion in the second quarter, up 11.4% from the year-ago quarter.

Global Payments’ Projections for 2022

The company forecasts net revenues, on a constant currency basis, to be within the $8.48-$8.55 billion range in 2022. This projection reflects a 10% to 11% increase from the previous year. The impact of forex woes is expected to be $180-$190 million on revenues in 2022.

Adjusted earnings (constant currency) are forecast to be $9.53-$9.75 per share, up 17%-20% from the previous year. Forex woes are likely to hurt the bottom line by $0.16-$0.19 per share.

Adjusted operating margin is predicted to grow 150 basis points (bps) in 2022, higher than 125 bps stated earlier.

The company’s Senior Executive Vice-President and CFO, Josh Whipple, said, “Our 2022 outlook presumes continuing recovery from the pandemic worldwide and a stable global macroeconomic environment throughout the remainder of this calendar year.”

Capital Allocation by Global Payments

In the first half of 2022, Global Payments generated net cash of $1.2 billion from its operating activities and held cash and cash equivalents of $1.93 billion at the end of the period. From its available resources, the company used approximately $0.32 billion on capital expenditures and $2.28 billion to repay long-term debts. Exiting the first half, the company’s long-term debt balance stood at $10.88 billion.

Meanwhile, the company rewarded its shareholders with dividends of $0.14 billion and share buybacks of $1.25 billion in the first half of 2022.

Important Announcements by Global Payments

Global Payments has communicated that Silver Lake, a leader in technology investing, will invest $1.5 billion in the company through convertible senior notes. Also, the company announced its decision to divest the consumer assets of Netspend for $1 billion. The buyer in the transaction is Searchlight Capital and Rev Worldwide.

In addition, Global Payments said that it has agreed to buy EVO Payments in a cash transaction valued at $34 per share.

Global Payments’ CEO, Jeff Sloan, said, “…we are delighted to announce we have entered into a definitive agreement to acquire EVO Payments for $4.0 billion, significantly increasing our target addressable markets, enhancing our leadership in integrated payments worldwide, expanding our presence in new and further scaling in existing faster growth geographies, and augmenting our business-to-business (or B2B) software and payment solutions.”

The company expects EVO Payments and Netspend transactions to conclude in the first quarter of 2023.

Wall Street Is Optimistic about Global Payments

On TipRanks, analysts are optimistic about the prospects of Global Payments, which commands a Strong Buy consensus rating based on 15 Buys and four Holds. GPN’s average price forecast of $166.50 reflects 30.1% upside potential from the current level.

Over the past year, shares of Global Payments have declined 24.95%.

Bloggers, Too, Are Bullish on Global Payments

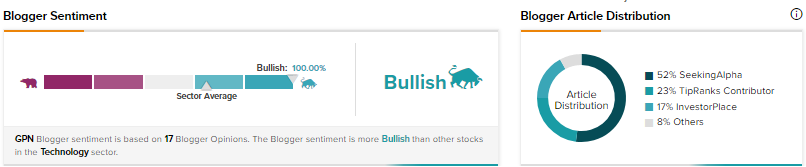

According to TipRanks, financial bloggers are 100% Bullish on GPN, compared to the sector average of 65%.

Key Takeaways for GPN Investors

Despite facing headwinds from forex woes, the prospects of Global Payments appear bright. Solid revenue and earnings growth expectations for 2022 underpin the growth story. Also, efforts to reshape the portfolio through divestments and buyouts, and the flow of funds from a leading technology investment company enhance the stock’s appeal.

Read full Disclosure