UP Fintech (NASDAQ:TIGR) shares surged nearly 20% at the time of writing after the online brokerage services provider posted a healthy set of second-quarter numbers. During the quarter, revenue soared by 23.6% year-over-year to $66.1 million. The figure cruised past estimates by $21.4 million. EPADS (Earnings Per American Depository Share) of $0.09 also handily beat estimates by $0.05. In comparison, the company had posted an EPADS of $0.02 in the year-ago quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In Q2, TIGR added 29,077 funded accounts, with the total number of funded accounts reaching 840,900 at the end of the quarter. While net asset inflows remained strong at $1.6 billion, the company saw a mark-to-market loss of $492 million owing to souring equity markets.

Impressively, its international expansion is bearing fruit, and the company’s average customer acquisition cost (CAC) has now moderated to $161 from $171 in the prior quarter.

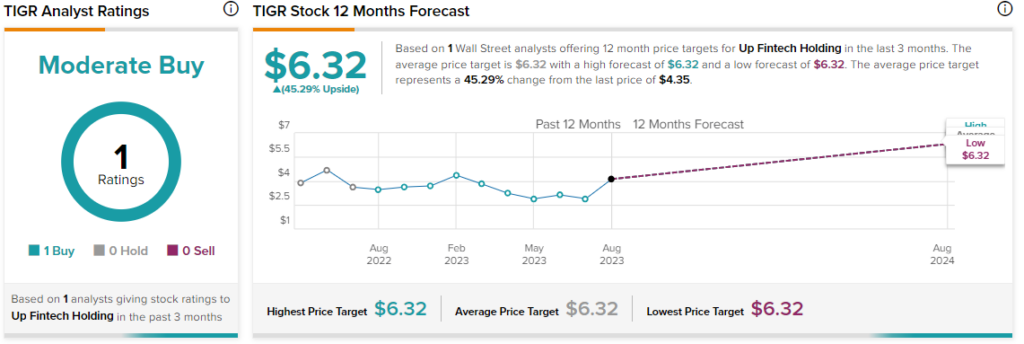

At present, Citi’s Judy Zhang, the lone analyst tracking TIGR, has reiterated a Buy rating on the stock alongside a $6.32 price target. This points to a nearly 45% potential upside in TIGR on top of a 40% price surge for the year so far.

Read full Disclosure