Shares of online brokerage platform UP Fintech (NASDAQ:TIGR) jumped nearly 7% in the early session today after its revenue in the third quarter increased by 26.6% year-over-year to $70.1 million. Similarly, earnings per American Depository Share (ADS) rose to $0.10 from $0.04 in the year-ago period.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The quarter was marked by a sequential improvement in commission income and interest-related income. During the quarter, the total account balance on the platform increased by 45.7% year-over-year to $18.9 billion. Further, the total number of funded accounts ticked higher by 24,604 to 865,500.

With a focus on user experience, TIGR introduced the Trading Sparks feature and added U.S. Treasuries to its wealth management platform. The Trading Sparks feature enables users to leverage trading ideas from the best-performing traders on the platform.

Is TIGR a Good Stock to Buy?

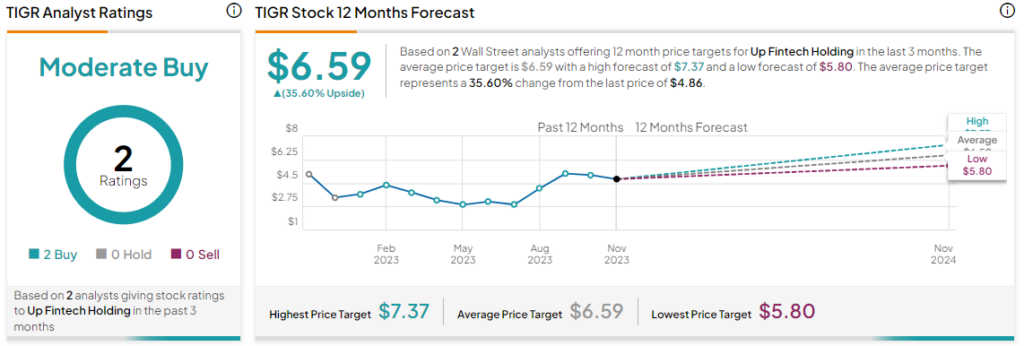

Overall, the Street has a Moderate Buy consensus rating on UP Fintech. Following a nearly 83% jump in the company’s share price over the past six months, the average TIGR price target of $6.59 implies a substantial 35.6% potential upside.

Read full Disclosure