Unity Software (U) has laid the groundwork for the future of augmented reality (AR) as the prime provider of the Unity game engine for creating virtual worlds and top mobile games. The company has an expansive reach as the backbone of 70% of the top mobile games with an average of 3.7 billion downloads per month. The company’s latest project, Unity 6, which is set to launch in fall 2024, promises to be the software’s most stable and high-performing version yet.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Although Unity’s stock has faced a recent downturn, shedding roughly 50% year-to-date, the appointment of a new CEO, significant partnerships, including one with Apple (AAPL) to support the development of iOS AR apps, and a clear strategy for the future position it well for the long term. The stock trades at an attractive valuation, making it a compelling option for tech-centric investors.

Unity Rolls Back Price Increase

Unity creates and operates interactive, real-time 3D (RT3D) content and offers end-to-end software solutions for developing, operating, and monetizing real-time 2D and 3D content. The platform caters to creators, including game developers, architects, automotive designers, and filmmakers. Unique features of Unity allow interactive content creation across various devices, such as mobile phones, tablets, PCs, consoles, and augmented and virtual reality gadgets.

Under the leadership of new CEO Matthew Bromberg, Unity has announced the cancellation of its Runtime Fee. The fee structure, which led to a developer uproar, will be replaced by more traditional price increases. These changes will take effect on January 1, 2025.

The Augmented Reality (AR) market is still in its early stages. However, substantial growth is anticipated, fueled by heightened gaming, media, entertainment, healthcare, logistics, and manufacturing adoption. Valued at $57.26 billion in 2023, it is projected to expand at a CAGR of 39.8% until 2030.

Analysis of Unity’s Recent Financial Results

The company recently announced its quarterly results for Q2 2024. Revenue of $426 million was down by 6% year-over-year, though it still beat analysts’ expectations by $7.52 million. The company reported a GAAP net loss of $126 million for the quarter, indicating a 35% improvement from a net loss of $193 million in Q2 2023.

The company’s adjusted EBITDA for the quarter was $113 million, a 29% improvement from $88 million in the same quarter last year and comfortably exceeding the forecasted guidance of $75 to $80 million. Due to cost control and increased cloud consumption for ML model training, the non-GAAP gross margin expanded to 84% compared to 81% in the same quarter of the previous year. Adjusted EBITDA margins reached 25% for the quarter, a substantial year-over-year increase of 850 basis points. GAAP earnings per share (EPS ) of $0.27 beats consensus projections by $0.14.

Following second-quarter mixed-bag results, U’s management has revised its guidance downwards due to the slower-than-anticipated impact of improvements in the ad network and level-play products. Third-quarter revenue is expected to range between $415 and $420 million, marking a 4-6% year-on-year decrease. The EBITDA for the same quarter is expected to be between $75 and $80 million. However, the company expects to maintain double-digit growth in the Create subscription business throughout the year.

What Is the Price Target for U Stock?

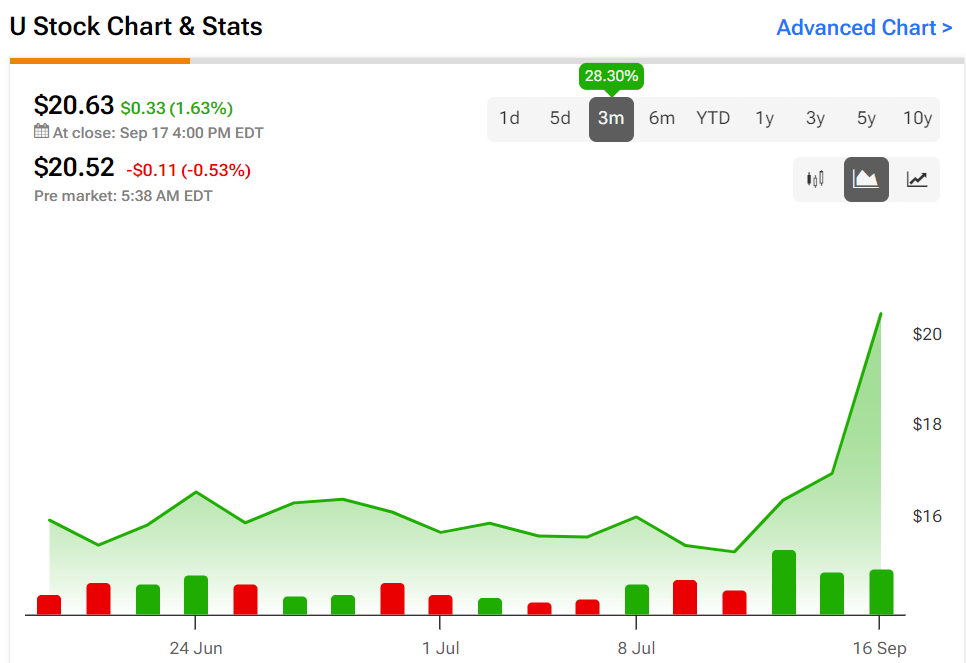

The stock has been on a volatile journey, with a beta of 2.48, as it shed 83% of its value over the past three years. However, in the past 90 days, it has jumped 32%. It trades at the lower end of its 52-week price range of $15.16 – $50.08 and shows positive momentum by trading above its 20-day (16.55) and 50-day (18.76) moving averages. With a P/S ratio of 3.84x, the stock appears relatively undervalued compared to the Software Application industry average of 6.8x.

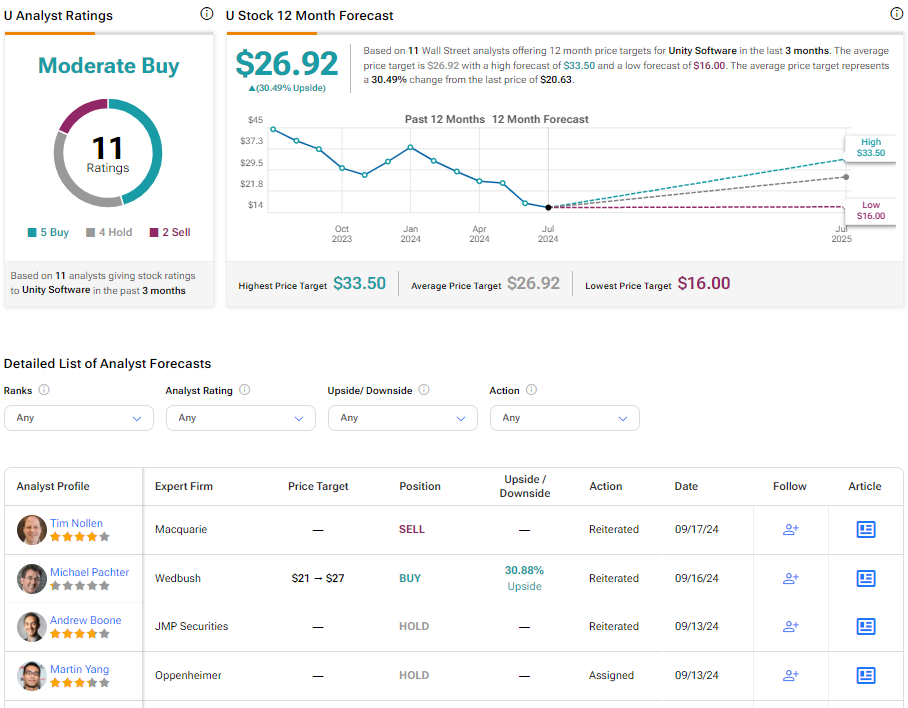

Analysts covering the company have been constructive on U stock. For example, Macquarie analyst Tim Nollen recently reiterated an Underperform rating on the shares while raising the price target to $15 from $12, noting the company’s plans to cancel its runtime fee, instead instituting price increases for Pro and Enterprise seat licenses in January 2025, a move enthusiastically greeted by users.

Unity Software is rated a Moderate Buy based on 11 analysts’ recent recommendations and price targets. The average price target for U stock is $26.92, representing a potential 30.49% upside from current levels.

Bottom Line on Unity

Despite a recent dip in stock value, Unity’s appointment of a new CEO, a robust partnership with Apple, and a strategic roadmap for the future places it in an advantageous position for long-term upside. Furthermore, Unity’s decision to replace the controversial Runtime Fee with traditional price increases shows a responsive approach to users’ feedback, cementing the company’s commitment to its customers.

Amidst recent challenges, such as lower-than-anticipated impacts of improvements in the ad network and level-play products that led to downward revised guidance, Unity is still poised for growth with an expected continued double-digit growth in the Create subscription business. Given its relative discount, Unity stock could be an appealing option for tech-savvy investors.