Fiber has been historically overbuilt, as it was assumed that demand would spike in the not-too-distant future. At present, the future seems to be at hand, as 5G and Artificial Intelligence (AI) are generating significant need for supporting fiber infrastructure. Uniti Group (NASDAQ:UNIT) is well-positioned to benefit from the 5G and AI boom.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite being up almost 95% in the past year, the stock trades at a relative value and shows the potential to climb to higher levels, and it pays a healthy dividend yield to boot. Tech investors looking for exposure to an AI/5G infrastructure play may want to dig deeper into this one.

Uniti Group’s Potential Catalysts

Uniti is structured as a real estate investment trust (REIT) focused on acquiring and constructing essential communication infrastructure for fiber and wireless communications. As of the close of 2023, Uniti’s portfolio included around 140,000 fiber route miles, 8.5 million fiber strand miles, and additional communication real estate throughout the United States. The company’s revenue is primarily wholesale, associated with longer-term contracts, which lends itself to more stable income and efficient operation.

It’s worth noting that the majority of Uniti’s fiber capacity remains vacant due to historical overbuilding and lower utilization rates. Despite just under a quarter of Uniti’s network capacity being active, it owns ‘dark’ metro fiber in around 300 markets across the country. This represents sizable potential for capital growth and efficient margins, particularly for enterprise, wireless backhaul, and small cell sectors. Uniti envisages these markets as critical areas for future growth, and expanding utilization rates could drive the stock higher.

In addition, according to Bloomberg, Uniti is reportedly in advanced discussions regarding a potential merger with Windstream, a telecommunications provider. While the terms of the merger have not been confirmed, the nature of the deal could act as another trigger driving the stock higher.

Uniti’s Recent Financial Results

The company’s fourth quarter 2023 financial results reported revenues of $285.7 million and a net income of $30.7 million. This reflects a positive turnaround from the year’s net loss of -$81.7 million. In terms of earnings per share, the company registered $0.13 per diluted common share in the fourth quarter, contrasting with a loss of -$0.35 for the entire year.

The company pays a quarterly dividend of $0.15, which has stayed consistent since 2020.

As of the end of the year, the company’s combined unrestricted cash and cash equivalents, along with undrawn revolving credit, totaled approximately $354 million. Management has given guidance for FY24 revenue in the range of $1.154 billion to $1.174 billion, which is slightly below consensus expectations of $1.2 billion.

What is the Price Target for UNIT Stock?

The stock has been trending up, climbing over 8% in the past 90 days, and currently trades towards the upper end of its 52-week price range of $3.06-$6.71. It appears relatively undervalued, with a P/S ratio of 1.2x sitting well below the REIT Specialty industry average of 5.9x.

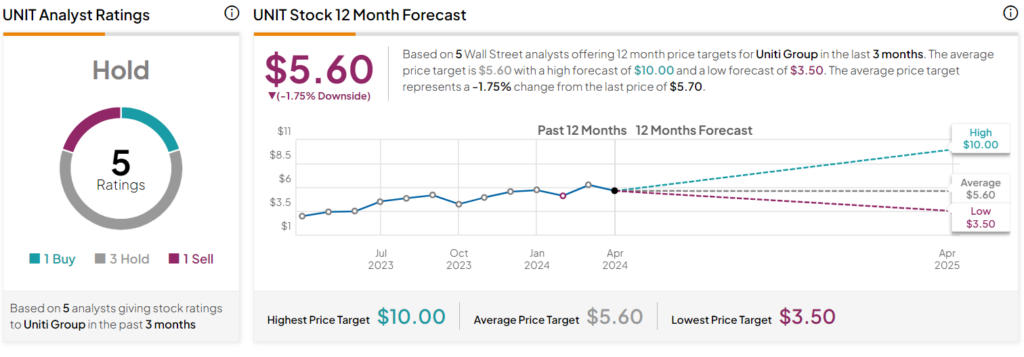

Analysts following the stock have taken a cautiously optimistic stance. For instance, TD Cowen analyst Gregory Williams raised the price target on Uniti Group from $9 to $10, while issuing a Buy rating on the shares, citing the firm’s guidance implying organic growth.

Uniti Group is rated a Hold based on the collective recommendations and 12-month price targets assigned by five Wall Street analysts over the past three months. The average price target for UNIT stock is $5.60, which represents a -1.75% downside from current levels.

Final Analysis on UNIT Stock

Given the current valuation level, robust dividend yield, and several potential catalysts that could increase the share price, Uniti Group’s shares appear compelling. However, if rumors of a tie-up with Windstream don’t bear fruit (or prove to be accurate but on terms disadvantageous to long-term shareholder value), or expectations of greater fiber utilization from hyperscalers go unmet, the stock could be in for a rather wild ride.