UnitedHealth Group (UNH) is testing a new AI system to make medical billing faster and less frustrating for doctors and patients, Bloomberg reported. The system, called Optum Real, is designed to simplify how doctors and billing staff determine whether a claim will be paid, even before it is submitted.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Importantly, Optum Real is developed by Optum Insight, UnitedHealth’s tech and analytics arm. It was designed to provide instant coverage validation and improve administrative efficiency for healthcare providers and insurers. The system uses real-time data exchange to resolve billing issues, improve transparency for patients, and reduce costs.

Currently, Optum Real is in its initial rollout phase. UnitedHealthcare, UnitedHealth’s insurance division, is the first health plan to adopt this technology. The company’s goal is to expand the platform to other insurers.

Also, Allina Health, a Minnesota-based health system, is one of the initial users. It has been piloting Optum Real for outpatient radiology and cardiology since March 2025.

AI Tackles a $200 Billion Problem

The U.S. healthcare system spends nearly $200 billion annually on administrative tasks such as claims processing and prior authorization. Optum Real is expected to save on these costs by using AI to interpret complex insurance rules and deliver real-time guidance to providers.

Remarkably, McKinsey & Company estimates that AI solutions can help save up to $300 million in admin costs, nearly $1 billion in medical costs, and boost revenue by as much as $1.24 billion.

Is UNH a Good Buy Right Now?

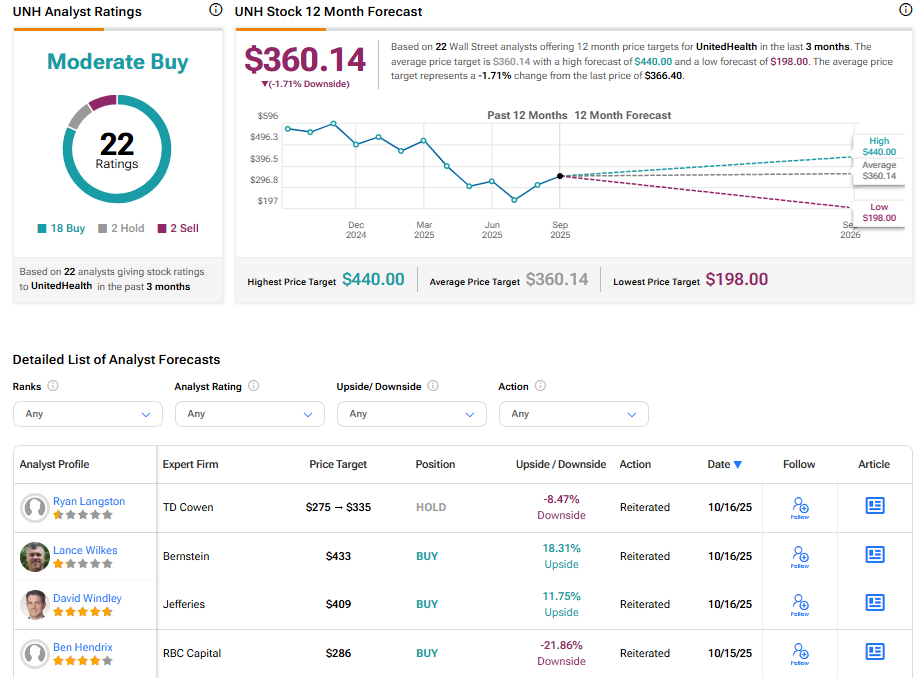

Turning to Wall Street, UNH stock has a Moderate Buy consensus rating based on 18 Buys, two Holds, and two Sells assigned in the last three months. At $360.14, the average UnitedHealth stock price target implies a 1.71% downside risk.