UnitedHealth (UNH), one of the prominent players in the health insurance space, is scheduled to announce its third-quarter earnings next week on October 28. The stock has dropped 27% year-to-date due to margin compression, high medical costs in the Medicare Advantage (MA) business, and the Department of Justice (DOJ) probe, among others. Wall Street analysts hold a moderately bullish view on the stock, with most expecting margin recovery in 2026 but limited upside in the near term.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

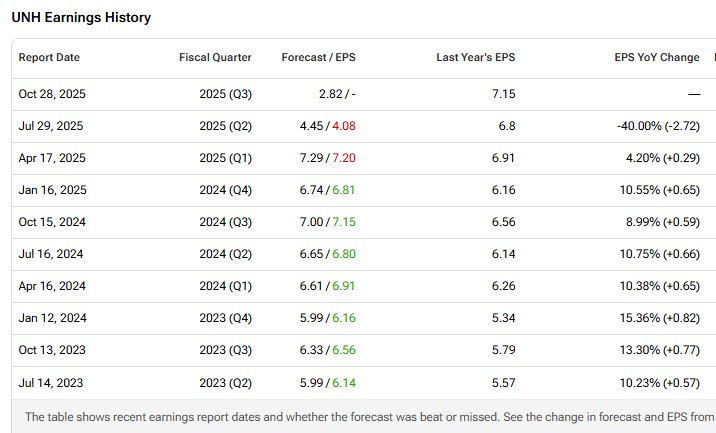

Analysts expect the company to report earnings per share of $2.82, representing a 61% decrease year-over-year. Meanwhile, revenues are expected to increase by 12% from the year-ago quarter to $113.04 billion, according to data from the TipRanks Forecast page.

It’s important to note that UNH has a decent track record with earnings, having exceeded EPS estimates in seven of the past nine consecutive quarters.

Recent News Ahead of Q3

Earlier this week, Bloomberg reported that UnitedHealth is testing a new AI system to make medical billing faster and less frustrating for doctors and patients. The system, called Optum Real, is designed to simplify how doctors and billing staff determine whether a claim will be paid, even before it is submitted.

Analysts’ Views Ahead of UNH’s Q3 Earnings

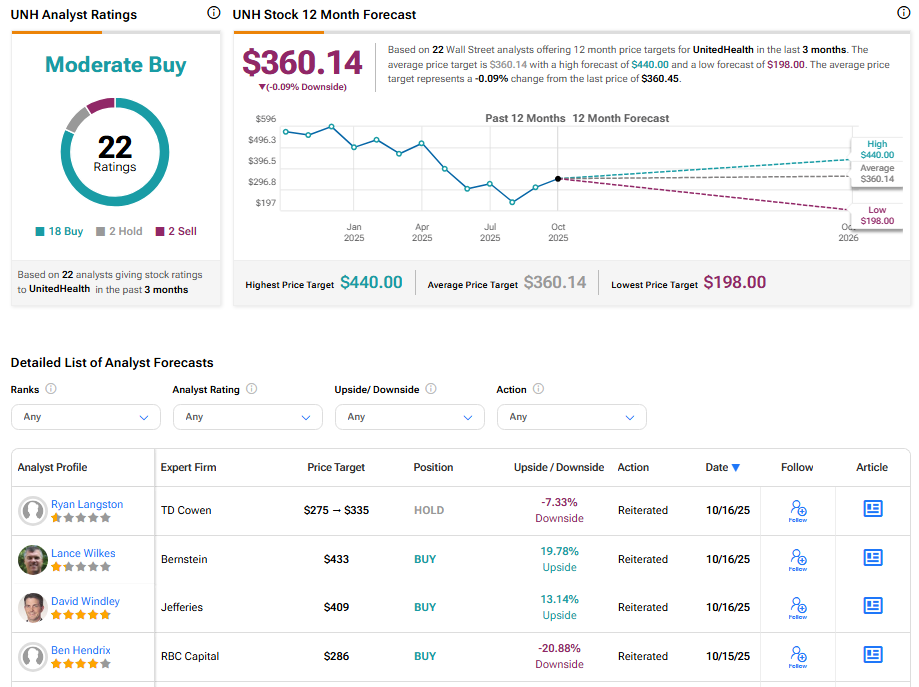

Heading into the Q3 print, TD Cowen analyst Ryan Langston raised his target to $335 from $275, while maintaining a Hold rating. The analyst cited optimism about the healthcare conglomerate’s long-term margin recovery, particularly in its Medicare Advantage (MA) business. Langston sees the 2027 MA Advance Notice as a key positive signal for UNH’s future margins.

However, Langston remains cautious about 2026 due to potential impacts from version 28 (v28) changes, which affect both UnitedHealthcare and Optum Health. For reference, v28 is a risk adjustment system used to predict healthcare costs.

Also, Jefferies analyst David Windley raised the firm’s price target on UNH to $409 from $317, while maintaining a Buy rating on the stock. Windley expects the company’s Medicare Advantage margins to improve in 2026, supported by strong group repricing initiatives. The firm estimates that the medical loss ratio (MLR) for Medicare Advantage will improve by about 100 basis points next year. Jefferies also projects an Optum Health (OHealth) margin of 5.7% in 2027, which is 210 basis points above the current consensus forecast of 3.6%.

Is UNH a Good Buy Now?

Turning to Wall Street, UNH stock has a Moderate Buy consensus rating based on 18 Buys, two Holds, and two Sells assigned in the past three months. At $360.14, the average UnitedHealth stock price target implies a 0.09% downside potential.