UnitedHealth Group (UNH) gained a new bull today, as Goldman Sachs initiated coverage of the health insurer’s stock with a Buy rating and a price target of $406. Moreover, Truist raised its price target for UNH stock to $410 from $365 while reiterating a Buy rating as part of a broader research note on the upcoming Q3 results of companies in the healthcare service sector.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Goldman Sachs Initiates Buy Rating on UNH Stock

Goldman Sachs analyst Scott Fidel initiated coverage of UnitedHealth, CVS Health (CVS), and Cigna (CI) stocks with Buy ratings. The analyst noted that the managed care industry faces its most significant underwriting downturn in over 15 years. Fidel recommends stocks with greater exposure to Medicare Advantage (MA), with his analysis reflecting that cyclical margin recovery is underway in 2026. However, Fidel expects a longer path to cyclical recovery in Medicaid and the healthcare exchange.

Fidel noted that the MA market has faced three years of fundamental pressure from 2023 to 2025, with margin recovery (beginning in 2026) expected to support earnings per share (EPS) growth for UNH and CVS from 2026 to 2028. Regarding MA Star scores, the analyst noted that UNH recently disclosed that it expects 78% of MA members to be in 4+ Star plans for 2026, removing a major short-term overhang for the stock.

With the new management team in place, Fidel expects UNH to focus on addressing stakeholder concerns, reviewing its business practices, and implementing more conservative pricing to reflect upwardly revised medical cost baselines across many key business lines.

Top Truist Analyst Raises Price Target for UnitedHealth Stock

Meanwhile, top Truist analyst David Macdonald increased his price target for UNH stock as part of a broader note on Q3 earnings of the healthcare service sector. The 5-star analyst is “broadly bullish” on the industry and expects ongoing strength in core demand drivers.

Macdonald continues to like the long-term positioning of names under Truist’s coverage within sector verticals, along with improved visibility into the regulatory environment. He added that solid free cash flows and attractive financial flexibility across most of the sector “underpins the ongoing growth investment.” Macdonald sees a “brisk opportunity” to deploy capital to further increase core growth and drive M&A deals.

Is UNH a Good Buy Right Now?

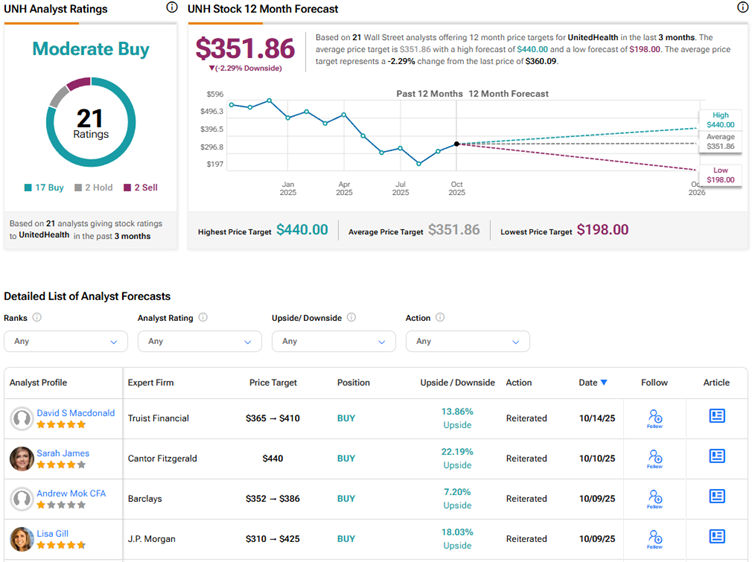

Overall, Wall Street has a Moderate Buy consensus rating on UnitedHealth stock based on 17 Buys, two Holds, and two Sell recommendations. The average UNH stock price target of $351.86 indicates a downside risk of 2.3%. UNH stock is down about 29% year-to-date due to several factors, including high medical costs, an abrupt CEO departure, and a U.S. Department of Justice probe.