Shares of healthcare company UnitedHealth (NYSE:UNH) gained in today’s trading as investors await its Q2 earnings results on July 16 before the market opens. Analysts are expecting earnings per share to come in at $6.71 on revenue of $98.8 billion. This equates to 9.3% and 6.5% year-over-year increases, respectively, according to TipRanks’ data.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is ideal because earnings per share should grow faster than revenue, as this demonstrates a high degree of operating and financial leverage in the business. It’s also worth noting that UNH has beaten earnings estimates every quarter since its 2020 Q3.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 6.43% move in either direction.

What Is the Future of UNH Stock?

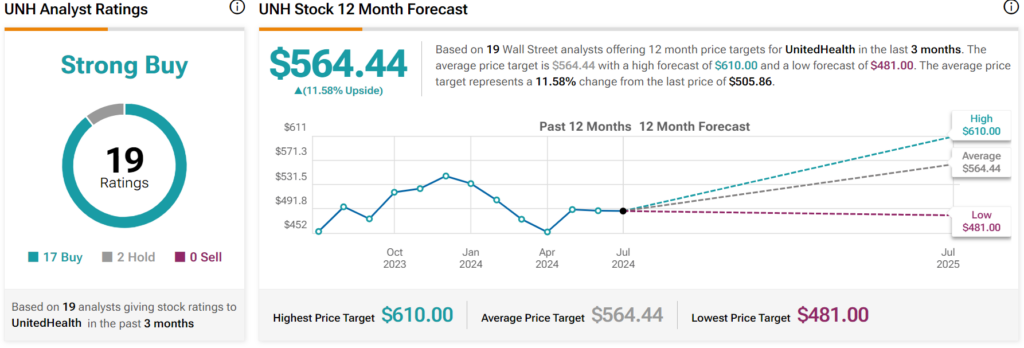

Overall, analysts have a Strong Buy consensus rating on UNH stock based on 17 Buys, two Holds, and zero Sells assigned in the past three months. After a 13% rally in its share price over the past year, the average UNH price target of $564.44 per share implies 11.58% upside potential.

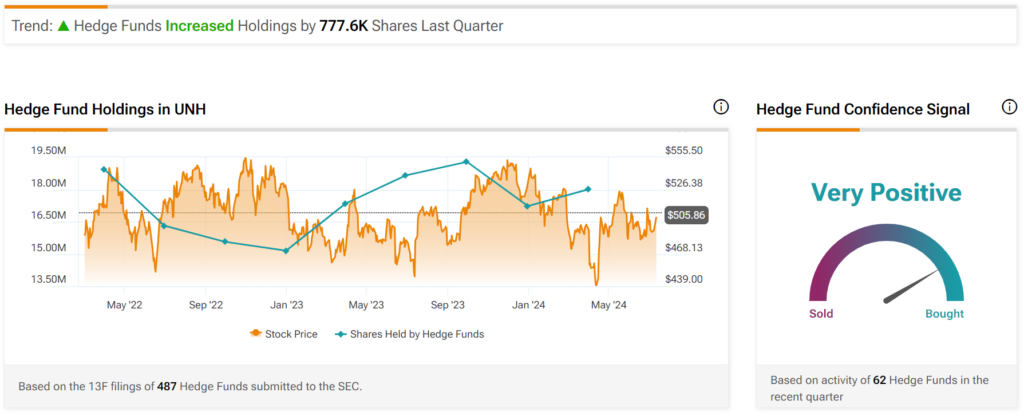

Hedge Funds seem to agree. When it comes to “smart money,” money managers seem to be confident in UNH stock. Indeed, hedge funds increased their holdings in the stock by 777,600 shares in the past quarter. As a result, they have a very positive confidence signal, as indicated by the graphic below.