United States Steel (NYSE:X) delivered better-than-expected fourth-quarter results. However, both earnings and revenue declined from the year-ago quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company manufactures and sells steel products. It operates through four segments: Flat-Rolled Products, Mini Mill, U.S. Steel Europe, and Tubular Products.

Q4 revenue fell 23% year-over-year to $4.34 billion but exceeded analysts’ expectations of $4.03 billion. The top line decreased due to the poor performance of Flat-Rolled, Mini Mill, and U.S. Steel Europe units.

Meanwhile, adjusted earnings tanked by approximately 83% to $0.87 but surpassed the Street’s expectations of $0.54. The company was also able to beat its own quarterly guidance with support from the improved performance of domestic steelmaking operations and the Tubular segment.

Total steel shipments during the quarter declined 10% year-over-year to 3.37 billion net tons. Regarding average realized prices in Q4, the price for flat-rolled and mini-mill steel slid 24% and 47%, respectively. The average price for tubular steel, however, increased by 83%.

Lastly, commenting on future performance, CEO David B. Burritt said, “Later this year, our non-grain oriented electrical steel line at Big River Steel will begin producing advanced steel grades to meet the growing electric vehicle demand.”

What is the Forecast of X Stock?

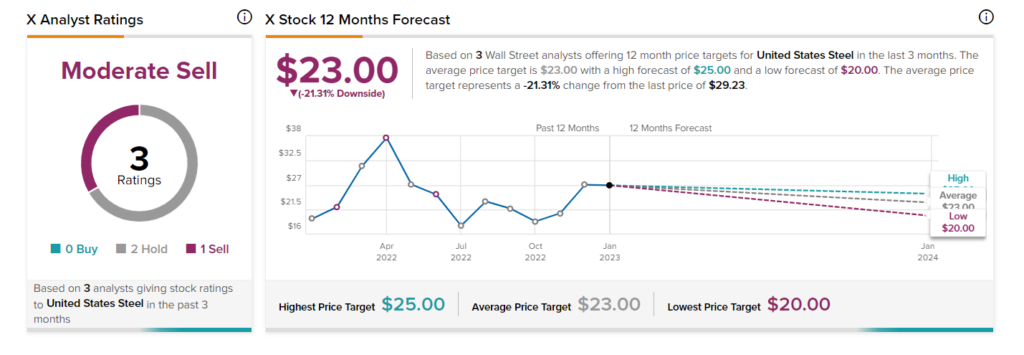

Wall Street analysts are bearish on X stock and have a Moderate Sell consensus rating, which is based on two Holds and one Sell. The average stock price target of $23 implies 21.3% downside potential.