United Rentals (URI) is the largest equipment rental firm in the world. The company serves its clients through two business segments; General Rentals and Trench, Power, and Fluid Solutions.

United Rentals recently announced strong fourth-quarter financial results for 2021. Overall revenues increased 21.8% to $2.8 billion on a year-over-year basis. Meanwhile, adjusted profits per share increased 12.3% year-over-year to $7.39. Higher rental income and fleet productivity drove the results.

In addition, the business approved a new $1 billion share repurchase program. The program is expected to start in the first quarter of 2022 and be completed by the end of the year.

Risk Factors

According to the new Tipranks’ tool, United Rentals’ main risk category is Finance & Corporate, which accounts for 49% of the total 35 risks identified. The next two major risk categories are Production and Legal & Regulatory, which stand at 23% and 11%, respectively.

The organization has added one new risk under the Production category.

United Rentals warns investors that, while supply chain disruptions have been limited thus far, they may become more severe in the future owing to a variety of factors. These disruptions might have an impact on the company’s capacity to procure equipment and other supplies on reasonable terms from essential suppliers. As a result, the firm may be unable to fulfill client demand, which might have a significant negative impact on its business and, as a result, on its financial operations and performance.

The Production risk factor’s sector average is 8.5%, compared to United Rentals’ 22.9%.

Wall Street’s Take

Following the Q4 earnings release, Jerry Revich of Goldman Sachs maintained a Buy rating on the stock and increased the price target to $425 from $415. This implies 32.9% upside potential to current levels.

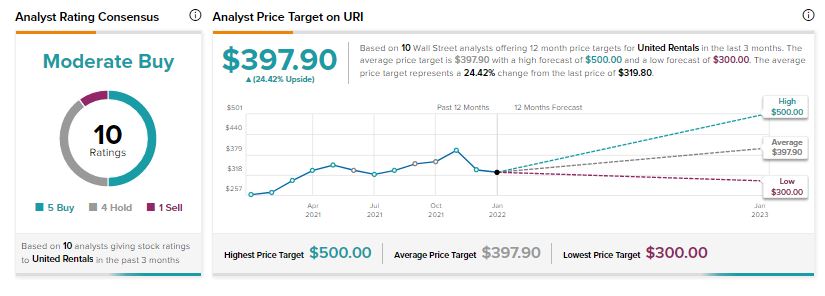

Turning to Wall Street, the stock has a Moderate Buy consensus rating based on 5 Buys, 4 Holds, and 1 Sell. The average URI price target of $397.90 implies 24.4% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News :

Fever-Tree 2022 Outlook Hampered by Costs; Shares Plunge

Qualtrics Posts Q4 Revenues Beat & Upbeat Guidance; Shares Up 10%

United Rentals Gains 4% on Strong Q4 Results; Announces $1B Share Buyback