United Airlines (NASDAQ:UAL) continued to be on an upward trajectory in pre-market trading after announcing better-than-expected Q1 results. However, the airline announced on Tuesday that it was slashing its aircraft delivery expectations for this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a result, United expects aircraft deliveries of just 61 new narrow-body planes this year, down from its prior forecast of 101 aircraft deliveries at the start of this year.

The company’s management stated in its Q1 earnings release that the airline adjusted its fleet plan to match manufacturers’ delivery capacity. United plans to use this opportunity to grow its mid-continent hubs and expand its international network from coastal hubs.

United’s aircraft delivery plans were impacted due to delays by aircraft manufacturer, Boeing (NYSE:BA) as it faces rising federal scrutiny and production restrictions. Instead, the company has now turned to Airbus (OTC:EADSY) and plans to lease 35 Airbus A321 Neos in 2026 and 2027.

United’s aircraft delivery plans were impacted due to delays by aircraft manufacturer Boeing (NYSE:BA) as it faces rising federal scrutiny and production restrictions. Instead, the company has now turned to Airbus (OTC:EADSY) and plans to lease 35 Airbus A321 Neos in 2026 and 2027.

Additionally, UAL has also reduced its annual capex to $6.5 billion from around $9 billion.

Is UAL Stock a Good Buy?

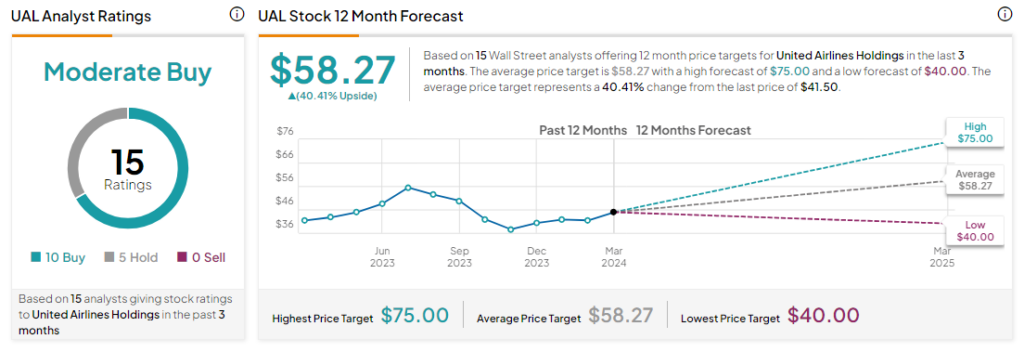

Analysts remain cautiously optimistic about UAL stock, with a Moderate Buy consensus rating based on 10 Buys and five Holds. Over the past year, UAL has declined by 2.1%, and the average UAL price target of $58.27 implies an upside potential of 40.4% from current levels.