An unexpected glitch hit earlier Tuesday as airline stock United Airlines (NASDAQ:UAL) asked the Federal Aviation Administration (FAA) for a ground halt and effectively stopped its own operations. While the halt was lifted not long after it was called for, it was enough for investors to grow unnerved and pull nearly 2.5% out of United’s market cap in the meantime.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What happened at United, according to reports from United itself, was that it was hit with a “…systemwide technology issue…” that called for all United air traffic to be held at its current departure airport. Planes that were already flying when the ground halt hit, meanwhile, could continue toward their destination but wouldn’t depart once they arrived. While the ground stop is now lifted, just what exactly happened to call for the ground stop in the first place is, as of yet, unknown.

Already, the government is taking aim at United. Transportation Secretary Pete Buttigieg routed questions from travelers to a government website, flightrights.org, to spell out just how airlines should respond to issues like this according to federal rules. Meanwhile, Sen. Eric Swalwell announced that he was the “top Dem on House Cyber Subcommittee” and that he would “…work to get more information to (his) constituents on this ground stop and whether it reflects a cyber threat.” With passengers increasingly concerned about airline reliability, that was likely the exact opposite of what they wanted to hear.

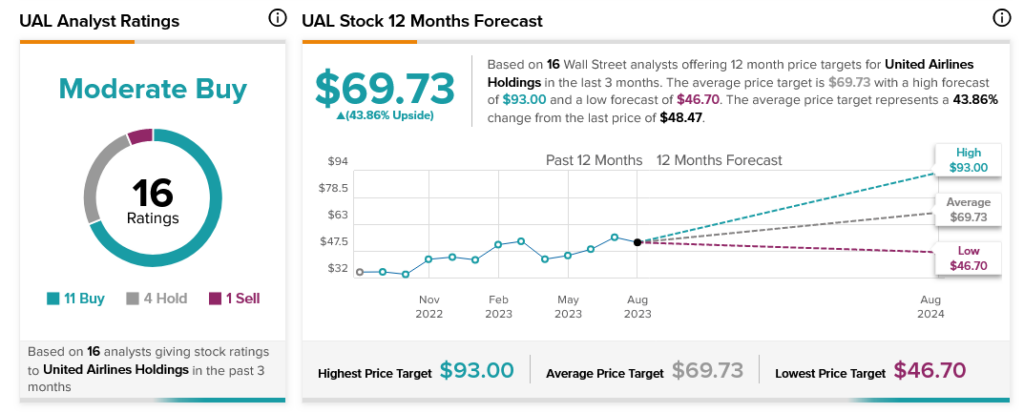

Analysts, however, are less than concerned. With 11 Buy ratings, four Holds, and one Sell, United Airlines stock stands as a Moderate Buy. Further, United Airlines stock offers investors 43.86% upside potential thanks to its average price target of $69.73.