While Union Pacific (NYSE:UNP) didn’t exactly post the greatest earnings report ever this quarter, it did manage to do something that captured the interest of investors across the spectrum. Because while Union Pacific’s numbers weren’t a big win, its choice for a new CEO managed to wipe out any troubles therein and send the stock up nearly 9% in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Union Pacific kicked things off from a position of weakness, and in a pretty big way. Its earnings report proved a double-bagger as misses go. It posted earnings of $2.57, which fell short of analysts’ expectations calling for $2.77. Meanwhile, its revenue came in at $5.96 billion, which was also short of analysts’ expectations that looked for $6.12 billion. Union Pacific’s revenue was also down against the same time the previous year, losing 4.9% against that figure. A combination of declining shipping volumes and a reduction in fuel surcharges—along with some general business mix issues—sent revenue slumping.

However, all of this proved meaningless to investors, as Union Pacific announced its new CEO: Jim Vena. Vena will ascend to the slot August 14, and is actually a veteran of Union Pacific itself. Vena was Union Pacific’s former chief operating officer, as well as a “senior advisor to the chairman.” Given that the search committee looking for a new CEO wanted “extensive railroad operating experience” as one of its leading measures, it’s little surprise Vena got the nod. However, it did prove a surprise to the market, as many were looking for Union Pacific to hire from outside the industry, not its former roster.

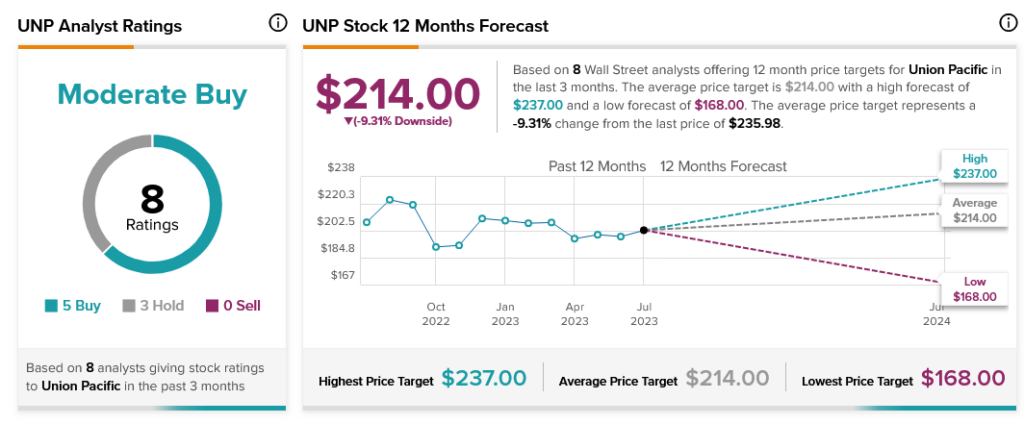

Analysts, meanwhile, are somewhat on the fence. Currently, Union Pacific stock is rated a Moderate Buy thanks to a near-perfect split of five Buy ratings and three Hold. However, with an average price target of $214, Union Pacific stock comes with a 9.31% downside risk.