Healthcare stocks remain resilient despite tariff pressures and policy uncertainty. The healthcare sector is often considered defensive as the demand for its products and services remains relatively stable compared to other sectors in an uncertain macro backdrop. Using TipRanks’ Stock Comparison Tool, we placed UnitedHealth (UNH), Eli Lilly (LLY), and Hims & Hers Health (HIMS) against each other to find the best healthcare stock, according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

UnitedHealth (NYSE:UNH) Stock

After a tough start to the year due to concerns about high medical costs in the Medicare Advantage (MA) business, the Department of Justice (DOJ) probe, weak financial results, and abrupt CEO departure, health insurer UnitedHealth has recovered 17% over the past month.

The factors that drove the recent recovery include disclosure of stakes by Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) and other hedge funds, reaffirmation of earnings guidance, and favorable updates on its MA Star ratings.

Despite the recent rebound, UNH stock is still down about 29% year-to-date, as the company’s turnaround is expected to take time. UNH recently announced that it will cease offering MA plans in 109 U.S. counties in 2026, representing about 600,000 members, as the company balances higher costs with reimbursement woes in the insurance program.

Is UNH a Good Stock to Buy?

Recently, Leerink Partners analyst Whit Mayo increased his price target for UnitedHealth stock to $402 from $300 and reiterated a Buy rating. The analyst adjusted his estimates and sees a more compelling upside case if the Optum recovery story improves more rapidly by 2027. In that scenario, Mayo expects an upside case for earnings per share (EPS) of $25, which is well above the consensus estimate of $21.

The analyst explained that he raised his out-year estimate as “Stars risks diminished, and what we feel is a solid floor of $16 of EPS this year, and what should be a multi-year path forward for enterprise margins.”

Overall, Wall Street has a Strong Buy consensus rating on UnitedHealth stock based on 17 Buys, two Holds, and one Sell recommendation. The average UNH stock price target of $331.68 indicates a downside risk of 8% from current levels.

Eli Lilly (NYSE:LLY) Stock

Eli Lilly has been delivering strong growth in its revenue and earnings, thanks to solid demand for tirzepatide, marketed under the brands Mounjaro for diabetes and Zepbound for weight management. In Q2 2025, Mounjaro sales grew 68% year-over-year to $5.2 billion, while Zepbound sales jumped 172% to $3.4 billion.

All eyes are now on orforglipron, Eli Lilly’s oral GLP-1 medication that is in development for type 2 diabetes and obesity. The pill, if approved, is expected to generate billions of dollars in revenue for Eli Lilly, given the massive global demand for weight loss medication.

Looking ahead, Eli Lilly has committed at least $27 billion to build four manufacturing plants in the U.S. amid the Trump administration’s push to boost domestic production.

Is Eli Lilly Stock a Buy or Sell?

Recently, Guggenheim analyst Seamus Fernandez reiterated a Buy rating on Eli Lilly stock with a price target of $875. Highlighting the key takeaways from a meeting with some executives, the 5-star analyst noted that LLY’s growth to date in 2025 is strong and “both seasonality and CVS formulary impacts are playing out as expected.”

The company expects continued strong growth of tirzepatide outside the U.S., as penetration into diabetes and self-pay obesity expands. Management anticipates that the orforglipron launch will further increase penetration in Type 2 Diabetes, opening up global access further and accelerating obesity market penetration worldwide. Despite macro uncertainty, Fernandez believes that Eli Lilly is well-positioned to avoid tariffs, given that it has broken ground in several U.S. states.

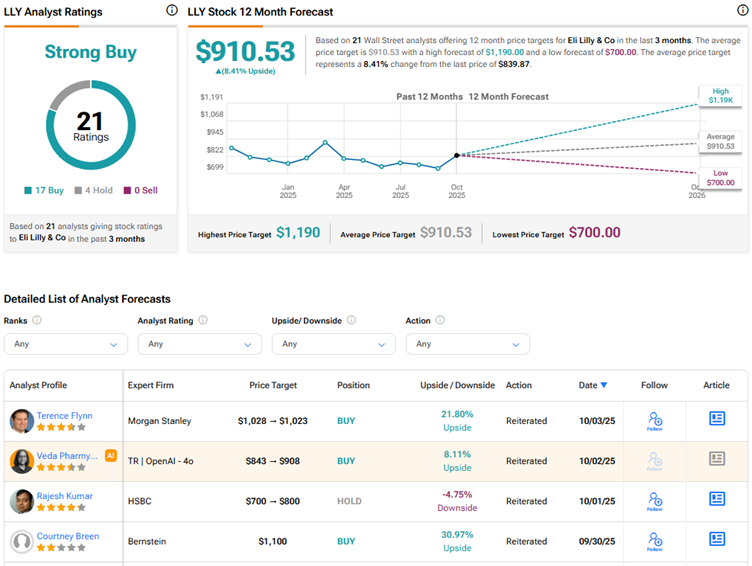

Currently, Wall Street has a Strong Buy consensus rating on Eli Lilly stock based on 17 Buys and four Hold recommendations. The average LLY stock price target of $910.53 indicates 8.4% upside potential. LLY stock has risen 9% year-to-date.

Hims & Hers Health (NYSE:HIMS) Stock

Telehealth platform Hims & Hers Health has seen its stock rally more than 117% year-to-date, despite its fallout with Novo Nordisk (NVO) due to allegations of deceptive marketing practices related to compounded weight-loss medications and the resultant legal risks.

The rise in HIMS stock price indicates investors’ optimism about the company’s growth prospects in several areas aside from the lucrative GLP-1 treatments. For instance, earlier this month, the company announced the launch of personalized treatment plans for low testosterone. Hims & Hers Health intends to expand its offerings in this segment in 2026 via the launch of Marius Pharmaceuticals’ oral testosterone Kyzatrex.

Overall, despite ongoing challenges, HIMS bulls are confident about its long-term growth, backed by its subscription model, which brings in recurring revenues, and improving profitability.

Is HIMS Stock a Good Buy?

Recently, Bank of America Securities analyst Allen Lutz reiterated a Sell rating on HIMS stock with a price target of $28. Lutz stated that the possibility of the telehealth platform delivering a Q3 beat is “less likely,” based on September sales trends through the first three weeks of the month. Notably, trends through the first three weeks indicate that September sales growth is tracking toward the low-to-mid 20s, implying that Q3 online revenue is “tracking closer to in-line or a slight miss” compared to the Street’s expectations.

Furthermore, Lutz is incrementally more cautious heading into the next two quarters due to the September trend and weakening order growth. He also sees a challenging setup for HIMS in the back half of 2025 due to tougher comparables resulting from the ramp-up of GLP-1 sales in late 2024, churn in the sexual health business due to the transition to more chronic solutions, and an increasingly competitive landscape.

Currently, Wall Street has a Hold consensus rating on Hims & Hers Health stock based on two Buys, seven Holds, and two Sell recommendations. The average HIMS stock price target of $49 indicates about 7% possible downside from current levels.

Conclusion

Wall Street is bullish on UnitedHealth and Eli Lilly stocks, but sidelined on Hims & Hers Health. Analysts see continued upside potential in Eli Lilly stock, while they expect possible downside in the other two healthcare players. Eli Lilly’s diversified portfolio across key therapeutic areas, dominant position in weight loss and diabetes markets, and solid fundamentals support Wall Street’s bullish thesis on the stock.