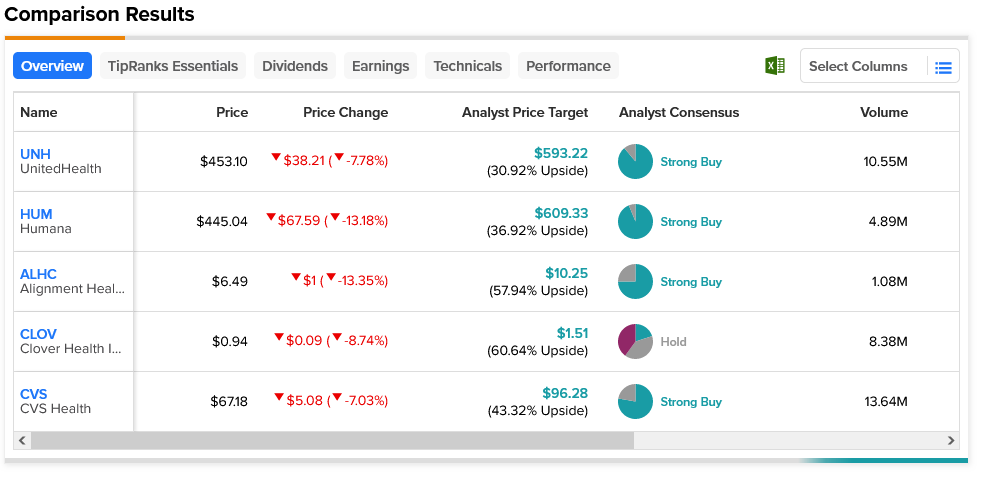

Halo effects work in both directions. Earlier today, we heard about Nike (NYSE:NKE) leading the uphill charge for footwear stocks. Now, health insurer stocks are getting a similar, but opposite, backward effect thanks to UnitedHealth (NYSE:UNH). United Healthcare’s recent drop is having an impact throughout the spectrum, sending down a range of stocks from Humana (NYSE:HUM) to Alignment Health (NASDAQ:ALHC) to Clover Health (NASDAQ:CLOV) to even CVS Health (NYSE:CVS).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

So what happened to send UnitedHealth down so far that it not only pulled several other health insurance providers along for the ride and took about 230 points off the Dow itself at one point? The answer is distressingly simple: a huge new number of surgeries. Remember when hospitals, by government mandate, were largely required to cut off surgical procedures for everything that wasn’t directly related to COVID-19 or an absolute emergency? Now, with COVID-19 largely in remission, surgeries are getting scheduled once again, and all that demand came flooding back with a big new bill for health insurers.

That led to UnitedHealth CFO, John Rex, noting that the medical care ratio—what part of premiums are actually spent on healthcare costs—will be under pressure as a result. With mask mandates coming to a close, even in doctors’ offices, less urgent surgeries like hip and knee replacements are back on the table, and back on the health insurer checkbook.

The losses have been staggering so far for health insurer stocks, and UnitedHealth wasn’t even the worst hit. That honor went to Alignment Healthcare, a Strong Buy by analyst consensus, but one that lost 13.35% at one point in Tuesday afternoon trading. However, it also offers the second highest upside potential, coming in at 57.94% with an average price target of $10.25. UnitedHealth, however, offers the lowest upside potential of 30.92% with an average price target of $593.22.