LiveOne, Inc. (LVO) is a music, entertainment and media services company that delivers premium content and livestreams from top artists globally. Its major subsidiaries include LiveXLive, PPVOne, Slacker Radio, React Presents, Gramophone Media and PodcastOne.

Let’s have a look at LVO’s recent second-quarter Fiscal 2022 performance and understand what has changed in its key risk factors that investors should know.

Revenue increased 50.6% year-over-year to $21.9 million, outperforming the consensus estimate by $0.72 million. Net loss per share of $0.19 was wider than the Street’s expectations by $0.07.

The CEO and Chairman of LVO, Robert Ellin, said, “With the return of live music events, we expect an increase in revenue from nearly every aspect of our flywheel – subscriptions, live ticket sales, live stream, pay-per-view, advertising, sponsorship, NFTs, and specialty merchandise.

“We continue to focus on the long-term objective of building and owning sustainable, valuable franchises in audio music, live music and events, podcasting/vodcasting, OTT, pay-per-view, and live streaming.” (See Insiders’ Hot Stocks on TipRanks)

In October, the company changed its name to LiveOne from LiveXLive Media. Further, it plans to rebrand its subsidiaries and businesses as the ‘ONE’ brand.

As of now, LVO has over 100 live shows lined up over the course of Fiscal 2022. The total number of its paid subscribers stands at over 1.25 million, as compared to 0.03 million at the end of September 2020.

Further, LVO is in the process of exploring strategic alternatives to enhance shareholder value and has roped in J.P. Morgan for the same. Potential actions can include acquisition, divestiture, merger, sale, or other types of business combination.

For Fiscal 2022, LVO has maintained its revenue guidance of $115 million to $125 million. The company has lowered its guidance for adjusted operating income to $0 to $3 million due to the impact from COVID-19 delta variant, weather conditions and higher anticipated spending on content and marketing.

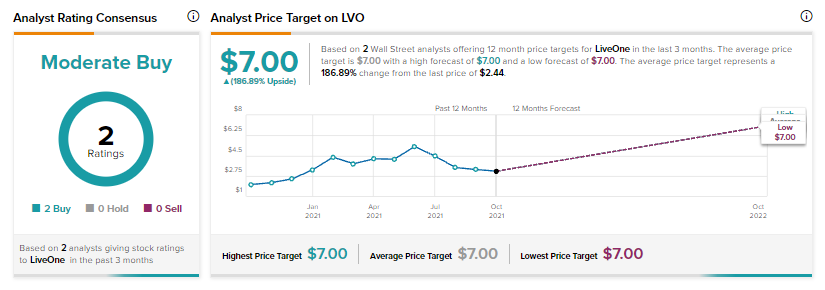

Consensus on the Street is a Moderate Buy based on 2 unanimous Buys. The average LiveOne price target of $7 implies upside potential of 186.9% for the stock.

Now, let’s have a look at what’s changed in the company’s key risk factors.

According to the new Tipranks’ Risk Factors tool, LVO’s top risk category is Finance & Corporate, which accounts for 29% of the total 119 risks identified. In its recent second-quarter report, the company has added one key risk factor under the Ability to Sell risk category.

LVO highlights that it generates a significant portion of its top-line from e-commerce merchandise sales and if it fails to maintain or increase this revenue stream then its financial results might see an adverse impact. Further, if the company fails to collect its receivables balance from customers then its results may see a negative impact.

The Ability to Sell risk factor’s sector average is at 18%, compared to LVO’s 26%. Despite a recent downturn, shares are up 27% over the past year.

Related News:

Amazon Drops 4% after Missing Q3 Expectations and Muted Q4 Outlook

AptarGroup Reports Q3 Earnings In Line with Expectations, Sales Beat

Logitech Posts Mixed Fiscal Q2 Results