AcelRx Pharmaceuticals,Inc. (ACRX) is focused on bringing to market therapies for moderate-to-severe acute pain.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Its DSUVIA (called DZUVEO in Europe) is targeted for managing acute pain. Its second product, Zalviso is being developed in the U.S. as a patient-controlled analgesia system to reduce moderate-to-severe pain in medically supervised settings. Both DSUVIA and Zalviso have received approval in Europe.

The company’s recent Q2 performance fell short of expectations on the revenue front. Earnings, on the other hand, were in line with consensus. (See ACRX stock charts on TipRanks)

Let’s take a look at AcelRx’s financial performance as well as what has changed in its key risk factors that investors should be aware of.

Q2 Results

AcelRx’s Q2 revenue dropped 85% year-over-year to $443,000, and lagged consensus by $182,000. The drop was attributable to a 98% decrease in Contract and other collaboration revenue as compared to a year-ago period. Product sales of the company registered a 29% year-over-year increase during this period, clocking in at $392,000.

In a positive, DSUVIA sales rose 117% sequentially in Q2.

Vince Angotti, CEO of AcelRx commented, “We continued to gain solid sales momentum with DSUVIA as the recent real-world data became more widely disseminated to healthcare providers, and elective surgery restrictions at ambulatory surgery centers and hospitals eased during the second quarter.”

ACRX’s net loss per share remained unchanged at $0.08 year-over-year, and was in line with expectations.

Importantly, AcelRx has entered into agreements with Laboratoire Aguettant for licensing DZUVEO in Europe. AcelRx will receive up to $55 million in up-front and sales-based milestones, along with two pre-filled syringe product candidates for the U.S. The estimated market opportunity for these candidates is north of $100 million, and AcelRx expects to file New Drug Applications for them in the next 12 months.

On August 17, H.C. Wainwright analyst Ed Arce reiterated a Buy rating on the stock, but lowered the price target to $5 from $7, which still implies a potential upside of 350.5% for the stock.

Arce commented on the Q2 results, “We are keeping a close eye on DSUVIA commercial sales, as we expected a more robust rebound following the relaxing of COVID-related restrictions in Q2. Further, we believe a persistent low level of sales makes it more difficult for DSUVIA to ramp quickly and meet our revenue growth trajectory projections.”

Risk Factors

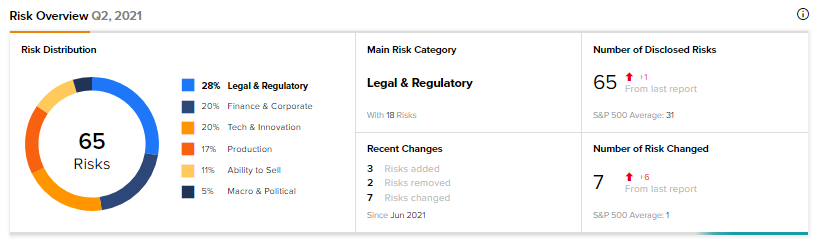

According to the new Tipranks Risk Factors tool, AcelRx’s main risk category is Legal & Regulatory, accounting for 28% of the total 65 risks identified. Since June, the company has added three key risk factors.

Under the Tech & Innovation risk category, AcelRx noted that its success is mainly dependent on the successful commercialization of DSUVIA, as the company has devoted substantial resources to its development and regulatory approval.

Under Legal & Regulatory, AcelRx acknowledged that litigation may significantly increase its costs and harm its business. The company is, and may in the future become, party to lawsuits and the expenses of defending them can be substantial, with no certain outcome.

Compared to a sector average Legal & Regulatory risk factor of 20%, AcelRx’s is at 28%. Shares are down 11.2% so far this year.

Related News:

A Look at GrowGeneration’s Earnings and Risk Factors

Toll Brothers’ Q3 Results Top Estimates; Shares Rise 1.9%

GrowGeneration Snaps Up Commercial Grow Supply; Shares Rise 4.5%