Omeros (OMER) stock surged on Wednesday after the biopharmaceutical company announced an asset purchase and license agreement with healthcare company Novo Nordisk (NVO). This agreement is tied to zaltenibart, a drug candidate in development to treat rare blood and kidney disorders. The antibody does so by inhibiting MASP-3, a protein that is a key activator of the complement system’s alternative pathway.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Omeros’ agreement with Novo Nordisk grants the company exclusive global rights to develop and commercialise zaltenibart in all indications. This comes with various payments for Omeros, including $340 million in upfront and near-term milestone payments. There’s also the option for it to receive up to $2.1 billion in potential development and commercial milestones. Finally, Omeros will receive tiered royalties on net sales of zaltenibart.

Novo Nordisk intends to conduct a Phase 3 clinical trial of zaltenibart after the deal with Omeros closes. This will follow up on a positive Phase 2 clinical trial conducted by Omeros. The company seeks to determine other potential indications for zaltenibart via this clinical trial.

Omeros & Novo Nordisk Stock Movements Today

Omeros stock was up 141.46% on Wednesday, extending a 5.97% year-to-date rally. Despite these gains, OMER shares have still slipped 0.97% over the past 12 months.

Novo Nordisk stock saw a moderate 0.34% rally on Wednesday, chipping away at a 32.58% drop year-to-date. The shares have also fallen 52% over the past 12 months.

Is Omeros Stock a Buy, Sell, or Hold?

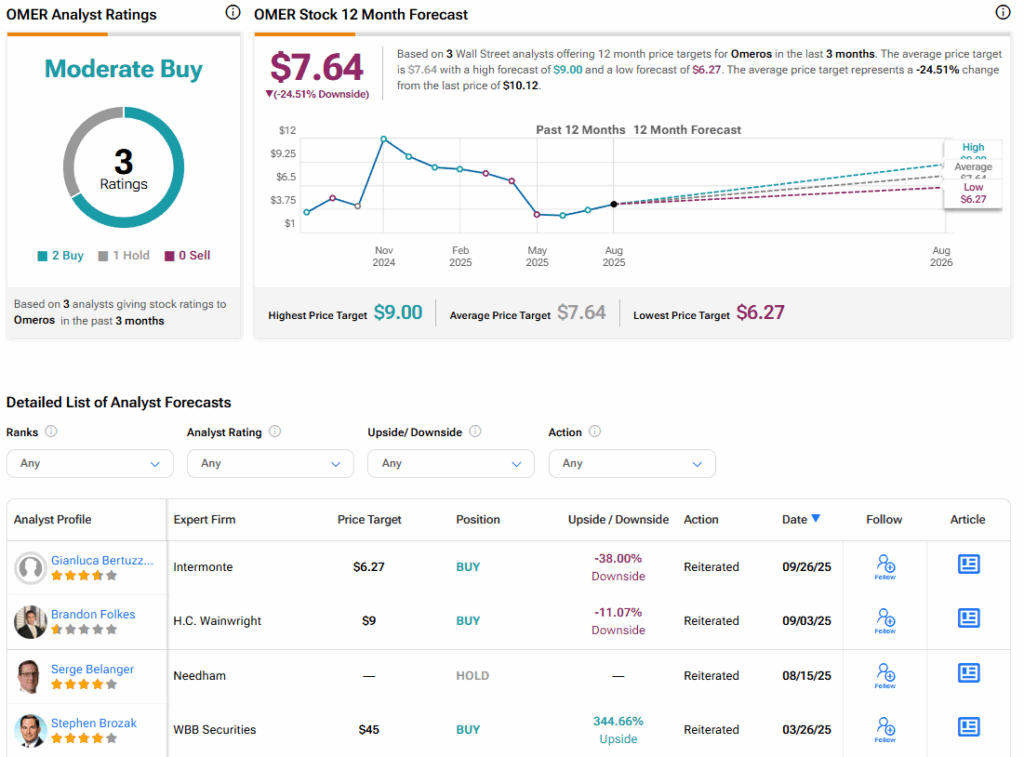

Turning to Wall Street, the analysts’ consensus rating for Omeros is Moderate Buy, based on two Buy and one Hold rating over the past three months. With that comes an average OMER stock price target of $7.64, representing a potential 24.51% downside for the shares.