Shares of Ulta Beauty (NASDAQ:ULTA) slipped in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at $6.68, which beat analysts’ consensus estimate of $5.69 per share. Sales increased by 18.3% year-over-year, with revenue hitting $3.23 billion. This beat analysts’ expectations of $2.99 billion.

Ulta Beauty posted wins on nearly every front. Comparable store sales were up 15.6%, with most of that increase coming from increased transactions. Those were up 13.6%, while the average ticket was up just 1.8%.

Looking forward, management now expects revenue for FY 2023 to be in the range of $10.95 billion to $11.05 billion, while EPS is expected to be in the range of $24.70 – $25.40.

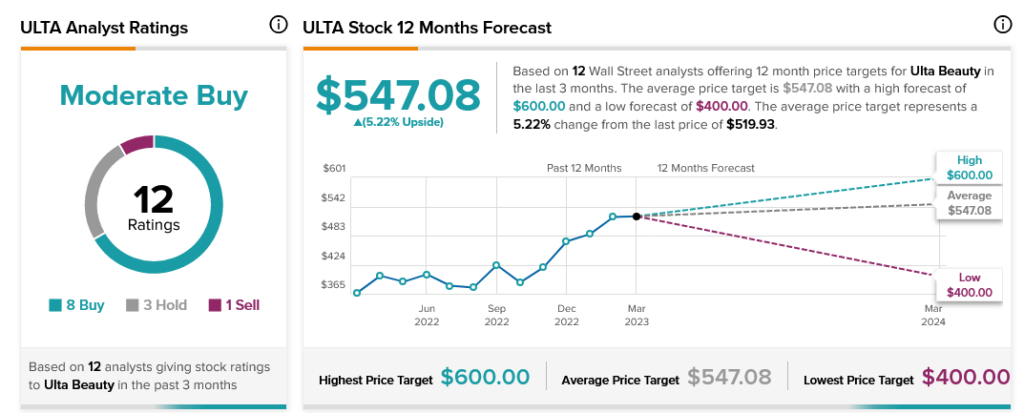

Overall, Wall Street has a Moderate Buy consensus rating on ULTA stock based on eight Buys, three Holds, and one Sell assigned in the past three months. In addition, the average price target of $547.08 implies 5.22% upside potential, as indicated by the graphic above.