Shares of beauty retailer Ulta Beauty (NASDAQ:ULTA) fell in after-hours trading despite posting Q4 earnings that surpassed expectations. This can be attributed to the company’s cautious outlook for 2024, as earnings guidance dampened investor enthusiasm.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earnings per share came in at $8.08, which beat analysts’ consensus estimate of $7.53 per share. Sales increased by 9.9% year-over-year, with revenue hitting $3.55 billion. This beat analysts’ expectations by $20 million.

Looking ahead, Ulta expects FY 2024 earnings and revenues to be in the ranges of $26.20 to $27 per share and $11.7 billion to $11.8 billion, respectively. For reference, analysts were expecting $27.03 per in earnings and revenue of $11.7 billion.

Is ULTA a Good Stock?

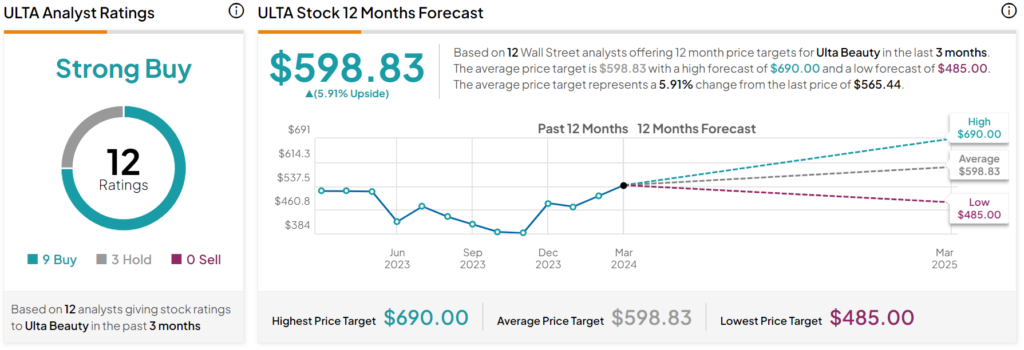

Turning to Wall Street, analysts have a Strong Buy consensus rating on ULTA stock based on nine Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 7.8% rally in its share price over the past year, the average ULTA price target of $598.83 per share implies 5.9% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.