Retailer Ulta Beauty (NASDAQ:ULTA) continued its string of losses today, which started around April 2 when CEO Dave Kimbell hit the JPMorgan retail conference and told attendees that things weren’t looking good. In fact, the losses continued into today, as Ulta shares fell over 2% in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Kimbell’s remarks hit the conference like a hammer blow, as he revealed that there would be “…a slowdown in the total category across price points and segments.” That sounds like a disaster, but not everyone was so convinced. Pauline Brown, former chair of LVMH, noted that what Kimball was likely calling for was less a declaration of disaster and more “…a bit of normalization.”

Brown further noted that “discretionary categories,” like beauty products, can see that normalizing process every so often. After all, look at the overall market. First, there were the COVID-19 lockdowns, which made beauty products largely moot. Then there was the release of restrictions, which brought them roaring back in that “pent-up demand” phase that President Trump looked for. Now, the pent-up demand phase has run its course, and normalcy is reasserting itself.

A Broader Problem?

It would be easy to think that Ulta reflects a broader trend. After all, most discretionary categories will get hit in an economic downturn, especially when inflation has driven the cost of food and energy through the roof. Though beauty products enjoy a bit of protection as consumers are loath to give up these “small luxuries,” we’re already seeing that they will, at least to some degree. However, the picture isn’t universal. Reports note that Sephora (OTHEROTC:LVMUY) saw an 11% rise in organic sales, suggesting that Ulta’s problems may be company-specific.

Is Ulta Beauty a Good Stock to Buy?

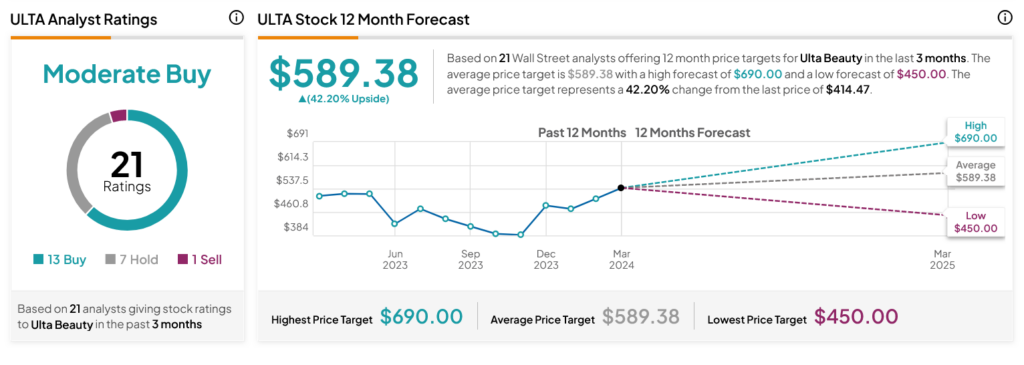

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ULTA stock based on 13 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 23.86% loss in its share price over the past year, the average ULTA price target of $589.38 per share implies 42.2% upside potential.