Swiss lender UBS Group (NYSE:UBS) has agreed to pay about $1.4 billion to solve the final piece of the puzzle related to the sale of residential mortgage-backed securities (RMBS). The bank is accused of having misled investors when it sold about 40 RMBS in the period between 2006 and 2007.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Regarding the accusations, The Department of Justice (DoJ) has asserted that UBS was aware that several loans supporting the RMBS did not adhere to the loan underwriting guidelines. Consequently, investors incurred substantial financial losses following the crisis.

UBS’ settlement represents the last outstanding case pursued by the DoJ. It is noteworthy that the DoJ has already reached settlements with 18 other financial entities, including JPMorgan (JPM), Bank of America (BAC), Wells Fargo (WFC), and Goldman Sachs (GS), regarding their practices related to mortgage-backed securities (MBS).

On the bright side, UBS mentioned that it had already allocated enough funds to cover the legal costs. During the first quarter, the bank allocated an additional $665 million to its reserves to meet such expenses.

Is UBS a Good Stock to Buy Now?

On TipRanks, UBS stock has a Moderate Buy consensus rating based on seven Buys, four Holds, and one Sell rating. The average UBS Group price forecast of $25.95 implies 10% upside potential from current levels. Meanwhile, UBS stock is up nearly 28% year-to-date.

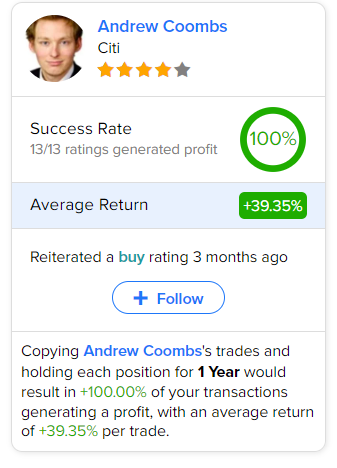

Moreover, investors looking for the most accurate and most profitable analyst for UBS could follow Citi analyst Andrew Coombs. Copying his trades on this stock and holding each position for one year could result in 100% of your transactions generating a profit, with an average return of an impressive 39.35% per trade.