Swiss banking giant UBS (NYSE:UBS) delivered lower-than-expected Q1 financial results. However, the financial services giant attracted $28 billion in net new money in its Global Wealth Management division. The firm highlighted that $7 billion of this new money came in the last ten days of March, following the announcement of its Credit Suisse (NYSE:CS)(GB:0QP5) acquisition.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While its Wealth Management segment attracted new money, higher provisions related to the U.S. RMBS (Residential Mortgage-Backed Securities) litigation matter weighed on its profitability. Its net profit fell approximately 52% to $1.03 billion, while its EPS of $0.32 came below the Street’s forecast of $0.52.

While UBS’ earnings came in lower than analysts’ expectations, its top line fell about 7% and missed the Street’s consensus estimate. It reported total revenue of $8.74 billion, compared to analysts’ estimates of $8.84 billion.

Looking ahead, UBS expects the uncertain macroeconomic situation to continue to impact client activity levels, which could adversely affect net new assets in our asset-gathering businesses in the second quarter. Nonetheless, the banking giant expects the higher interest rates to drive its net interest income in Q2. At the same time, deleveraging of its balance sheet in the Americas and other regions could stall the growth of net new loans.

UBS expects to complete the acquisition of Credit Suisse in the second quarter of 2023, which will boost its Global Wealth Management division. It was earlier announced that adding Credit Suisse will strengthen UBS’ competitive positioning in the Wealth Management segment and create a business with over $5 trillion in total invested assets. Further, UBS expects the deal to be accretive to its earnings by 2027.

Is UBS a Buy, Sell, or Hold?

UBS is well-capitalized, with its capital ratios coming ahead of its guidance in Q1. However, near-term macro headwinds keep analysts cautiously optimistic about the stock.

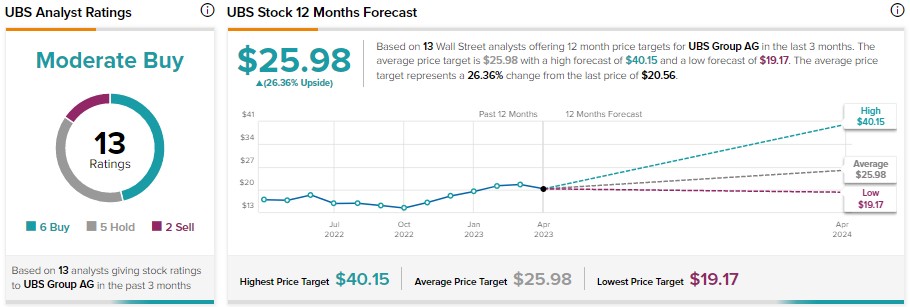

UBS stock has received six Buy, five Hold, and two Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $25.98 implies 26.36% upside potential.